Investors' rights boosted

Updated: 2013-10-17 07:12

By Chen Jia (China Daily)

|

|||||||||||

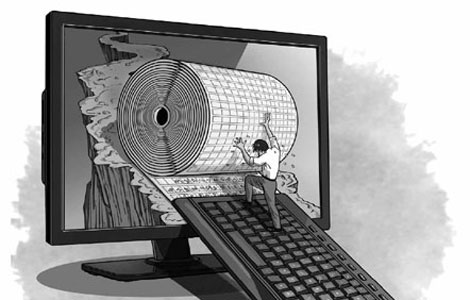

The top securities regulator reiterated the need to protect the legal interests of medium-sized and small investors in the capital market by redesigning the regulatory system.

|

A lack of small investors' protection is restraining development of the domestic capital market, Xiao Gang, chairman of the China Securities Regulatory Commission, wrote in an article published in People's Daily on Wednesday.

It sends a message that the securities watchdog is determined to resolve longstanding contradictions in the under-performing markets and rebalance the relationship between small investors and large corporate shareholders, analysts said.

The chairman's governing ideology has become clearer, although he has given few public speeches or published much on the subject. Emphasizing strict law enforcement, battling insider trading and protecting investors have distinguished Xiao's policies from those of his predecessors.

In Wednesday's article, Xiao pointed out that the current regulation system lacks a specific mechanism to protect investors' legal interests, but focuses more on ensuring the market's financing functions.

He said that under the current policy, large shareholders can deprive small investors of profits through mobilizing large amounts of capital.

"Information asymmetry, unsound returns on investment mechanisms, law and regulation violations by listed companies and incomplete rights protection have all damaged investors' interests," said Xiao.

According to data from the commission, about 90 million individual investors have opened accounts on the Shanghai and Shenzhen stock exchanges. Sixty percent of all share transactions are from investors with less than 500,000 yuan ($82,000) in their accounts.

"To protect the medium-sized and small investors is to protect the whole market," the chairman said.

Xiao stressed the need to protect investors' rights to complete corporate disclosure.

He also called for the approval of preferred shares, which have so far been excluded from the stock market.

In addition, Xiao demanded the establishment of escrow funds to expand the sources of compensation payments. He said he wants to launch a delisting risk management system to reduce small investors' potential losses.

On Tuesday, the commission opened official micro blogs on four large websites, including the most popular, Sina Weibo and Tencent Weibo, the Chinese Twitter-like micro-blogging services.

The number of "followers" of the official commission accounts on the relatively new form of social media is booming. On Sina Weibo alone, more than 100,000 followers were attracted in one day.

The commission posts every day's stock market transaction data, clarifies market rumors as soon as possible and runs a complaints channel so investors can protect their legal rights on the official commission Weibo site.

Almost 1,000 readers have left comments under each message on the website.

Many comments have poured in about the poor performance of the stock market. Others have called for measures to curb manipulation and stimulate the market.

Li Daxiao, head of the research department at Yingda Securities Co, said the social media platform will help the commission sustain a stable market.

"It has shown a more open and transparent attitude toward supervision of the institution, which can improve communications between regulators and investors," Li said.

Because of a more convenient case-reporting system, the commission received an increasing number of claims about violations in the securities market. In September, the commission started investigations into 39 cases, which was 15 times the total number in the first eight months of the year, said a commission spokesman.

Related Stories

Investors focus on catering company 2013-10-16 08:46

Shunfeng appointed as strategic investor for Suntech 2013-10-10 08:55

China's investor confidence rises 2013-10-09 10:13

'Negative list' will shepherd investors 2013-09-30 08:58

Chinese service sectors opened to foreign investors 2013-09-28 08:59

Two energy futures coming for investors 2013-09-24 16:13

Today's Top News

No secret papers for Russia, says Snowden

China, EU move toward investment talks

Growth 'paves way for reforms'

Executives in Asia top the global pay league

Typhoon-ravaged Chinese city recovers from flooding

Mandatory student internships under fire

Shanghai to reduce PM2.5 20%

Workers' right to a rest stressed

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|