The HK-Shanghai win-win vision

Updated: 2013-10-15 07:22

By Dan Steinbock (China Daily)

|

|||||||||||

The Shanghai free trade zone, which formally opened on Sept 29, could expand to eventually cover the entire Pudong area since the FTZ plan is part of China's financial reforms.

Over half a decade, China's equity, bond, and currency markets have expanded significantly. Commercial banks have increased their lending, expanded the bond market and are moving gradually toward the securitization of loan portfolios. In the process, they are opening the door to foreign investors and financial institutions.

The renminbi is already one of the 10 most actively traded currencies, and the Shanghai FTZ could help it become a fully convertible currency in a few years.

But what do these great changes mean to Hong Kong as a financial hub? And is there a win-win scenario that would allow Shanghai and Hong Kong both to support China's financial development?

Even in the 1920s, Shanghai was a major center of international trade and finance in East Asia. The shine of the "Pearl of the Orient" faded with the turmoil of the 1930s. Hong Kong, in contrast, benefited from global integration in the post-World War II era. As Shanghai fell into a commercial oblivion, Hong Kong thrived. Indeed, Hong Kong's rise continued during the first decade of the reform and opening-up policies because they began in the neighboring Guangdong province.

In Shanghai, the development of Pudong was initiated in 1992. But even after 1997, Hong Kong enjoyed another extraordinary decade and half as the Chinese mainland's financial lifeline.

Today, Hong Kong has a deeper pool of financial services than Shanghai. Shanghai's stock market has larger market capitalization than Hong Kong's but fewer listed companies. It is still dominated by retail investors, which means higher volatility. Until recently, Hong Kong enjoyed an edge in certain financial services and segments, but Shanghai is catching up fast.

A new era dawned in March 2009, when the State Council, China's cabinet, approved Shanghai's plan to forge itself into one of the world's leading financial, trade and shipping centers by 2020 - China's global financial and logistics hub.

How should Hong Kong respond to the competitive challenge? It could merge with Shenzhen, the mainland's first and most successful special economic zone, which has a population of more than 10 million, per capita income of over $18,000 and GDP of $178 billion.

A merger between an "aging" Hong Kong and a "youthful" Shenzhen would create a megacity of 17 million people and a GDP of $421 billion. Shanghai has a lower per capita income, of $13,000, but its population is close to 24 million and GDP more than $300 billion.

But differences in political systems pose a great challenge for a Hong Kong-Shenzhen combine, even though the past three decades have highlighted commonalities between the two major cities.

There is also an alternative scenario, which would pose fewer political challenges and bring great economic gains. Even without merging with Shenzhen, Hong Kong could deepen its economic cooperation with the mainland through Guangdong - which has a population of about 100 million and is accelerating its regional integration to spread the gains of development from a handful of megacities across the province.

The combined GDP of Hong Kong and Guangdong is already about $915 billion, higher than that of the Republic of Korea or Mexico. Indeed, a powerful regional market could benefit from synergies between Shenzhen and Guangdong on the one hand, and the entrepreneurial and innovative spirit of Hong Kong on the other.

In other words, China's financial development has three future scenarios.

A single financial center: The United Kingdom has its City (London). The United States has its Wall Street. So China, too, should have its Shanghai given its economic scale and network effects. The tradeoff would be erosion of Hong Kong's capabilities, which would be a loss to the mainland's financial development.

More financial centers: After the end of World War II, the US became the global financial leader with a population of just 140 million. China's population today is 10 times more. And since its scale is of different magnitude, it could have two or more financial centers. But this scenario would reduce Shanghai's economic scale and conflict with the State Council's decision.

Transitional stage: In this scenario, China will be supported by two major financial hubs - Shanghai and Hong Kong - in the short term. In the longer term, one major financial hub, Shanghai, would be supported by a few smaller hubs that will focus on regional and market niches.

The competition among Chinese financial centers does not have to be a win-lose game as long as different hubs have different geographic or business roles. If Shanghai is evolving into a kind of broad and diversified New York Stock Exchange with Chinese characteristics, Hong Kong and the Pearl River Delta region could energize into a NASDAQ-like technology market.

Shanghai is likely to prevail as China's global financial hub. Hong Kong and Guangdong are expected to continue boosting innovation and entrepreneurship. That, in turn, would benefit China's financial development and support the shift toward consumption-led growth.

The author is research director of International Business at India China and America Institute (US) and visiting fellow at Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).

Related Stories

SBI JV for Shanghai FTZ 2013-10-11 17:28

Shanghai FTZ will benefit financial reform 2013-10-10 08:55

Shanghai FTZ starts offering registration services 2013-10-09 17:28

Market in antiques booms in Shanghai 2013-10-01 23:53

Decades-long reforms pave way for Shanghai FTZ 2013-09-30 17:02

Cultural policies issued for Shanghai FTZ 2013-09-30 11:20

Today's Top News

Holding a mirror to China's economy through cosmetics

All 86 tourists evacuated from Mount Qomolangma

UK 'open' to Chinese nuclear investment

Easier UK visas to lure Chinese

Trending news across China Oct 15

Norwegian government resigns

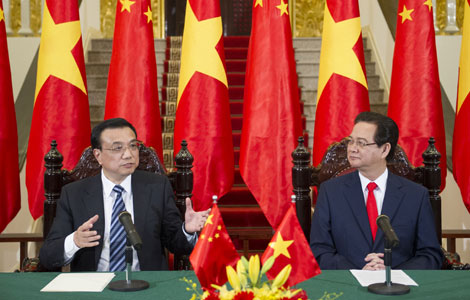

Premier seeks talks over dispute

Canton Fair to promote yuan use

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|