Zhong An wraps up registration

Updated: 2013-10-15 07:37

By He Wei in Shanghai (China Daily)

|

|||||||||||

Alibaba-backed online insurance company becomes nation's first

China's first online insurance firm, backed by the country's leading Internet companies and insurer, has completed its industrial and commercial registration in Shanghai, based on hopes that the existing customer bases and "big data" will fuel business for the virtual venture.

Co-founded by Alibaba Group Holding Ltd, Tencent Holdings Ltd and Ping An Insurance (Group) Co of China Ltd, Zhong An Online Property Insurance Co was all set to go by wrapping up its business registration on Oct 9, becoming the first completely online entrant in China's 1.55 trillion yuan ($253.5 billion) insurance sector.

With a registered capital of 1 billion yuan, the joint venture is headquartered in Shanghai's downtown Huangpu district and aims to focus on enterprise/family property insurance, cargo transportation insurance and liability and guarantee insurance, according to a notice published on the website of Shanghai Administration for Industry and Commerce.

Zhong An did not reveal the progress of the business setup, according to a spokeswoman who asked not to be named, saying that the company will publish its operational conditions "in due time".

Alibaba, with a 19.9 percent stake, is the new company's biggest shareholder. It also declined to comment on the issue.

Ping An Insurance and Tencent each hold a 5 percent stake. There are also six smaller shareholders including online travel agent services provider ctrip.com, IT company Rising Technology Corp Ltd and several investment firms.

Ping An's Chairman Peter Ma, who oversees the world's second-largest insurer by market value, told a news briefing in August that Ping An will leverage Alibaba's and Tencent's Internet strength to cooperate in the insurance industry.

The newly established insurer may sell traditional and innovative new types of policies to millions of users that may include creating policies against fake goods for buyers on Alibaba's Taobao and Tmall platforms. Online games insurance targeting users of Tencent may be viable.

Alibaba and Tencent, both Internet titans, are hoping to transform their huge user bases into diverse sources of income. According to Beijing IT consultancy Analysys International, more than three-quarters of China's online transactions are completed via Alibaba, while Tencent's instant messaging service QQ has recorded some 800 million users.

"The launch of the online insurance business will deal a blow to traditional sales channels such as banks because both firms are at the forefront in the e-commerce and social networking sectors," according to a research note by Zhang Meng, an analyst with Analysys International.

The penetration rate is around just 2 percent in China even as premiums have grown about 20 percent annually since 2002, leaving the vast country largely underinsured compared with the rest of Asia, according to a report by consultancy PriceWaterhouseCoopers in December.

But the study said growing concern about the sustainability of the agent sales channel is prompting insurers to come up with new distribution channels.

Traditional insurers are anxious to team up with Internet leaders in an industry known for its conservative business model and high barriers of entry can be transformed into a modern, forward-thinking enterprise, said market insiders.

When Allianz China Life Insurance Co Ltd partnered with Alibaba's Taobao to sell what was called Full-Moon Insurance, the German insurer believed the Internet had become an essential force to generate new ideas and develop new products. Insurance firms are masterful at tweaking and optimizing products, said Song Xuanbi, vice-chief operating officer of Allianz China. Under the policy, residents of 41 cities in China could get insurance in case they could not see a full moon during the Mid-Autumn Festival. For a 20 yuan premium, the Chinese could insure seeing a full moon. If cloudy skies obscured the view the companies would pay out 50 yuan.

The new venture may look "destined for very lackluster results" because of the diverse demographic composition of the two approaches, according to Doug Young, a financial journalism professor at Fudan University and a columnist at the South China Morning Post newspaper.

He argued that the average buyer of insurance is an older adult, probably aged around 45, whereas the average Tencent customer is probably around 22 or 23 and probably seldom thinks of things such as insurance and the average Alibaba user is probably just a little bit older.

"Even at a more fundamental level, insurance simply isn't something that can be sold effectively in China because of the newness of the product, with most Chinese considering such products a waste of money because they don't provide any immediate returns for the investor," said Young.

hewei@chinadaily.com.cn

|

Alibaba Group Holding Ltd's headquarters in Hangzhou, Zhejiang province. The company, with a 19.9 percent stake, is Zhong An Online Property Insurance Co's biggest shareholder. Provided to China Daily |

(China Daily 10/15/2013 page17)

Today's Top News

All 86 tourists evacuated from Mount Qomolangma

UK 'open' to Chinese nuclear investment

Easier UK visas to lure Chinese

Trending news across China Oct 15

Norwegian government resigns

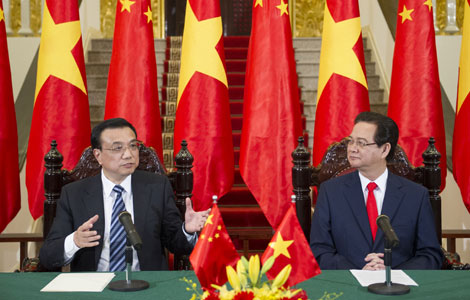

Premier seeks talks over dispute

Canton Fair to promote yuan use

Sept CPI rise hits 7-month high

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|