Insurance firms over the moon about online policy sales

Updated: 2013-08-28 07:58

By He Wei (China Daily)

|

|||||||||||

Internet companies are finding it increasingly attractive to team up with insurers to sell policies online, where existing customer bases and "big data" will help fuel growth for both.

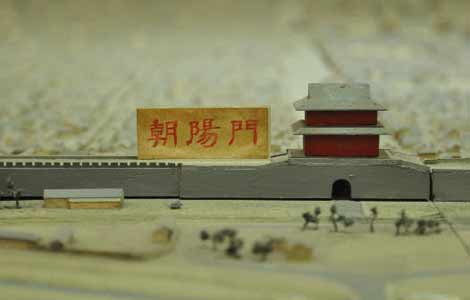

The partnership between Taobao.com, China's largest customer-to-customer online marketplace, and Allianz China Life Insurance Co Ltd to sell full-moon insurance for the coming mid-Autumn Festival, is just one example of how the Web is transforming an industry known for its conservative business model and high barriers to entry.

Customers who are concerned about not seeing the moon during the holiday can purchase a policy that compensates them if clouds obscure the sight and sour their celebrations.

This is seen as the most innovative endeavor since Taobao's parent, Alibaba Group Holding Ltd, set foot in the financial sector's territory three years ago, when it conducted the first batch of online settlements for insurance firms.

As the insurance industry is masterful at tweaking and optimizing products, the online platform offers a new twist on the old model for insurers. Online, products with high yields and rapid turnover can become a reality, said Song Xuanbi, vice-chief operating officer of Allianz China.

"The Internet has gone far beyond being a mere sales channel, becoming an essential force for us to generate new ideas and develop new products," he said.

A growing number of insurance brokers have also moved online to keep pace with the Internet age, said Jiang Xing, general manager of Taobao's insurance business unit. He said the platform has attracted at least 22 major insurance firms and led to more than 1 billion transactions.

The Internet is an easy, low-risk testing ground for products, creative executions and messaging, said Jiang.

A milestone product launched by Taobao and Huatai Insurance Group is shipping fee insurance, which protects the rights of buyers and sellers when an item needs to be returned.

The product was a response to surging e-commerce, which grew into a 1-trillion-yuan ($163 billion) business for Taobao and its B2C counterpart, Tmall, in 2012.

Unlike other channels, the Internet provides instantaneous results and online tracking opportunities are exceptional, said Ge Ruichao, public relations officer of Alibaba's planned Small and Micro Financial Services Co.

Alibaba's rationale for getting into finance is based on making insurance more transparent, easier to understand and "more accessible", he said.

"We wanted to offer a policy that allows customers to see, in easy-to-understand language, what's included in a policy, how much it costs and how to make a claim," he said.

Insurance brokers are more than willing to embrace such formats, as they add a cost-effective distribution channel, said Zhou Xiye, regional vice-president of global health benefits for Cigna and CMC Life Insurance Co.

Those destined for success offer single products on a single site, commit to the direct marketing formula, take ownership of the technology and leverage the database-building abilities of the Web, Zhou said.

But the marketing involved only applies to policies that are easy to comprehend and feature low premiums, he noted.

"For instance, health insurance is not likely to be an ideal product for online sales, because it requires applicants to give a lot of health information, which needs to be verified," he said.

Regulators have given the green light to innovation on the insurance front. In February, the China Insurance Regulatory Commission approved a new online insurance joint venture among the country's leading insurer and Internet companies.

The proposed company, Zhong An Online Property Insurance, co-founded by Alibaba, Tencent Holdings Ltd and Ping An Insurance (Group) Co of China Ltd, was the first completely online entrant in China's 1.55 trillion yuan insurance sector. The company will focus on liability and guarantee insurance.

But it won't have any storefront operations where clients can make claims. It will handle all claims and sales online.

There are risks, of course. Customers have to be sure the policies are genuine, so they need to be comfortable shopping online and informed about insurance, warned Xu Wenhu, head of the insurance department of Fudan University in Shanghai.

(China Daily 08/28/2013 page14)

Today's Top News

Sino-Japanese meeting at G20 ruled out

Japan coast guard seeks more money

Party's plenum to focus on reform

Industrial sector's profit picture brightens

Rich Chinese eye overseas properties

New time limits for visa processing

China joins global effort to combat tax evasion

Chinese negotiator in DPRK

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|