Shipping lines adrift in stormy economic seas

Updated: 2013-07-19 07:32

By Zhong Nan (China Daily)

|

|||||||||||

|

China Cosco Holding Co Ltd invested heavily to expand capacity in 2008, when international freight rates were at record highs. But as the economy further slows and demand shrinks, its huge capacity has become a big liability. Xu Peiqin / For China Daily |

Limited cashflows, weak demand, higher costs batter hard-hit sector

Even though China's first-half export performance was stable, the vast shipping sector will remain vulnerable as limited cashflows, lower freight rates and tight liquidity squeeze the industry.

Zhang Shouguo, vice-president of the China Shipowners' Association, said the country's shipping industry is at a critical point as it grapples with waning demand and higher costs, and many small businesses face bankruptcy.

Despite tough global economic conditions, China's exports rose 10.4 percent to $1.05 trillion while imports increased 6.7 percent to $944.87 billion. But those gains didn't do much for the shipping industry.

"The industry's troubles are likely to persist due to overall weak demand, depressed freight rates and price wars," Zhang said. "In the container business, capacity management needs to be more aggressive to restore the demand and supply relationship."

The Shanghai Containerized Freight Index, which measures outbound container rates, has fallen to one of its lowest points in recent years. The current cost of transporting a container to Europe is about $720, far below the break-even point.

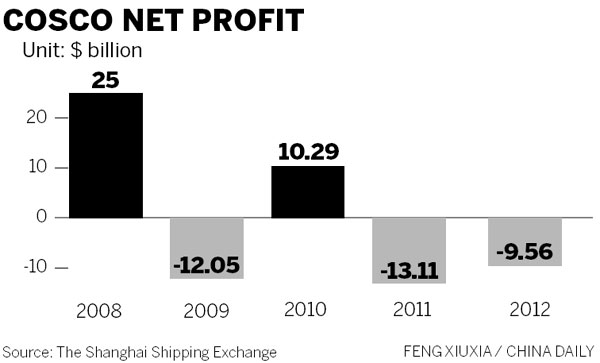

China Cosco Holding Co Ltd, the country's biggest shipping company, said first-half operating revenue rose 0.69 percent to 3.63 billion yuan ($591 million). It posted a loss of 78 million yuan, compared with a year-earlier loss of 4.87 billion yuan.

Cosco Shipping Co, another Cosco listed unit, said its first-half net loss tripled to 78 million yuan, the latest sign that slowing growth in China is eroding corporate earnings.

The Chinese shipping giant invested heavily to expand capacity in 2008, when international freight rates were at record highs. But as the economy further slows and demand shrinks, its huge capacity has become a big liability.

"The global shipping industry, often seen as a barometer of the health of the world economy, sustained a heavy blow from the recent global economic woes.

"Cosco's troubles are part of a broader industry shakeout that has been exacerbated by the nation's rise as a global shipping power," said Liu Bin, a professor at Dalian Maritime University in Liaoning province.

Liu said although the world economy is recovering slowly, both developed and emerging economies such as China, Brazil, France and Germany have reduced their commodity demand.

Unpredictable United States currency policies and falling commodity prices have also forced international goods traders and governments to lower their expectations for global trade.

"Because the flagging European and US economies and increased shipping capacity have led to long-term lower profitability, Chinese shipping companies will continue to struggle in the second half of the year as the nation is experiencing an economic slowdown and high oil prices," said Zhou Liwei, a researcher at the China Classification Society in Beijing.

Given expectations of a further global slowdown in the second half, analysts don't expect the shipping sector to return to profitability in the short term. Most Chinese shipping lines hope to get government subsidies or aid.

Tan Li, general manager of strategic development at China Cosco Holding, said the company is looking more carefully at certain market segments to make a profit.

"Although the container and bulk cargo businesses are being squeezed, 60 percent of our capacity is concentrated in the multi-purpose heavy lift on board," Tan said.

"In addition, about 30 percent of our capacity is concentrated in special vessels. For the drilling-vessel business in 2014, in 2015, we see a rising trend," Tan said.

Rather than waiting for the government policy to stimulate the market, the management team of China Cosco Holdings plans to sell Cosco Logistics Co to State-backed parent company China Ocean Shipping (Group) Co for 6.74 billion yuan.

The sale will give China Cosco a pretax gain of about 1.96 billion yuan by the end of this year.

China Shipping Container Lines Co Ltd, another major shipping firm, is keen to invest $1.51 billion to equip six liquefied natural gas carriers from Shanghai-based Hudong-Zhonghua Shipbuilding (Group) Co Ltd.

Meng Lingru, an industry analyst with Shanxi Securities Co, said China's economy is still dominated to some extent by investment policies and packages, which could help big shipping companies find new market growth.

"China's urbanization means more buildings, roads and manufacturing facilities will be built in cities and towns, which could save its shipping industry as cities demand more grain, commodities, raw materials and energy," Meng said.

"Thus, any investment-based stimulus methods will shore up its shipping industry, which has been struggling with harsh market conditions in recent years."

zhongnan@chinadaily.com.cn

(China Daily 07/19/2013 page17)

Today's Top News

China's government spends less in 2012

Obama weighs canceling Moscow talks with Putin

Xi hails closer cooperation with Switzerland

Yuan: Collateral types to expand

Overall home price rise softens

'Downside risk can be managed'

Detroit files biggest ever US municipal bankruptcy

Mandela turns 95 in hospital bed

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|