Investors urged to think health

Updated: 2013-06-24 07:40

By Liu Jie (China Daily)

|

|||||||||||

|

A private hospital in Changsha, Hunan province. Private hospitals have been growing rapidly in China and their number has increased by nearly 50 percent from 2008 to 2011. Provided to China Daily |

Opportunities as opening-up of hospital sector enters golden era

The full opening-up of China's hospital market is providing huge opportunities for foreign investors although risks exist, according to an industrial report from The Boston Consulting Group.

China's hospital market is approaching a golden era of growth and ready to embrace additional private capital, including overseas funds, according to Chun Wu, partner and managing director of BCG Greater China and also co-author of the report.

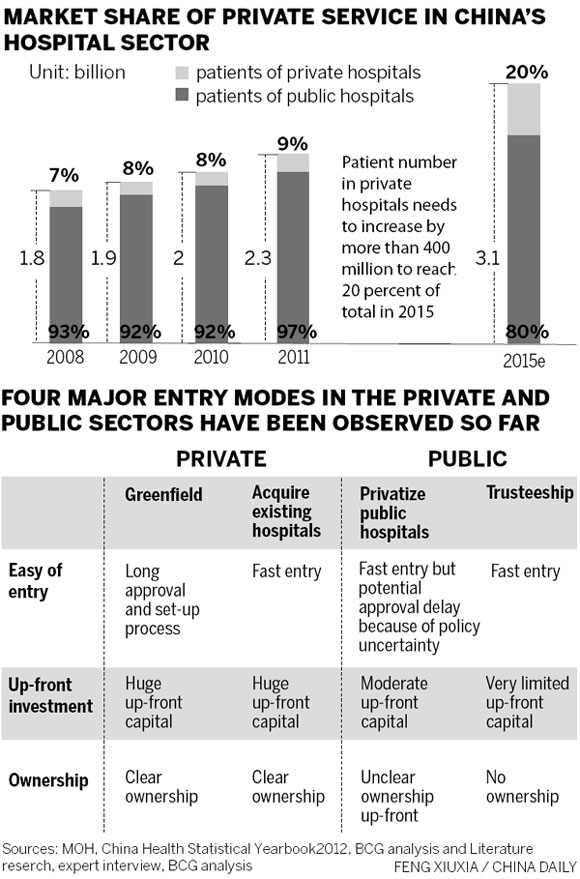

Total revenue for hospitals in China exceeded 1.25 trillion yuan ($204 million) in 2011. Private hospitals have been growing rapidly and the number of private hospitals has increased by nearly 50 percent from 2008 to 2011, statistics from the former Ministry of Health show. The Chinese government has set a goal to increase the private service contribution to the whole hospital industry to 20 percent by 2015 from less than 10 percent today.

"The investment opportunities in the hospital sector tend to emerge in waves," said Wu.

Different segments

Broadly speaking, there are several hospital segments that have investment potential. As private hospitals, there are high-end, specialty chains, general, extended care and group hospitals. In the public sector, there are general hospitals undergoing privatization.

In the short term and also taking place now, high-end and specialty chain hospitals are in the vanguard of the change. In the middle term - within three to five years - high-end and specialty chains will continue to thrive, while general hospitals, both private and public undergoing privatization, will become key investment opportunities. "We expect extended care will emerge in the medium to long term," said the report.

General hospitals will see further growth and large hospital groups should emerge through mergers and acquisitions and industry consolidation in the long term.

Investors need to be mindful of the development trends within each segment and develop a deep understanding of segment-specific requirements, the competitive landscape and key success factors in order to identify the best targets.

In the high-end hospital sector, the key to success is the patient-centric mindset that is based on a very fundamental understanding of the needs of target users, which is then reflected in the branding, service and talent requirements.

|

For specialty chain hospitals, operations that can be easily replicated are the cornerstone. Strong brand reputations and the ability to develop the talent pool are needed to fuel expansion. Players must develop relevant strengths according to the unique characteristics of each specialty segment, said the report.

General hospitals may be the most challenging. Comprehensive capabilities are required, ranging from obtaining policy support, general and specialty expertise development and getting the required talent, operation and process management potential in a transitional labor environment, rebranding or brand-building and, finally, maintaining sufficient scale.

Differentiated positioning and scalability enabled by standardization are strongly desired characteristics in the extended care segment. Easy access to patients from hospitals is also critical.

For the hospital groups segment, still in the burgeoning stage in China, in addition to the comprehensive capability requirements for general hospitals, the ability to realize scale and synergy will be crucial to success, the report said.

Market entry

Investors in the hospital market have four typical modes of entry, involving greenfield or organic growth, acquisition of private hospitals, privatization of public hospitals and the establishment of trusteeships of public hospitals.

To private, especially overseas, investors, some China-specific valuation challenges must be addressed, including opaque hospital financial systems, endemic unethical practices and uncertainty owing to regulatory and human resources risks.

Concerning the management of invested assets, investors typically need to pull four levers for good returns. They are hospital governance, operational quality and efficiency, product portfolio and expansion opportunities.

Foreign investors can be divided into two groups - financial investors such as private equity and venture capital businesses and strategic medical investors, such as United Family Health, which has hospitals in the three cities of Beijing, Shanghai and Tianjin so far, according to Yu Tian, co-author of the report.

"Overseas financial investors can enjoy similar profits to local investors as the market opens up because neither actually plays much of a role in the day-to-day running of hospitals," said Wu. "For strategic investors, things are more complicated."

The greatest challenge for private investors might be talent. Taking United Family Health as an example, today overseas physicians still account for a significant portion and local doctors receive training in the United States regularly. So far, human resources costs take up more than half of the company's revenues, far higher than the industry average.

The company is expanding its patients from expatriates in Shanghai and Beijing to the top 3 to 5 percent of all high earners in the top 10 cities in China.

"That needs more local doctors with high skills and good reputations because foreign physicians usually have language barriers with local patients and may not be able to fully understand local people's physical, social and psychological conditions," said Wu.

However, employing more good Chinese doctors is not easy because the big public hospitals in China can provide technical titles for their medical practitioners that are closely linked with welfare benefits such as pensions after retirement. The private hospitals cannot offer such kinds of packages.

The report also provides tips for potential investors in China's hospital market. They are selecting the right segment and target, making an early entry to lock up high-quality targets, choosing the appropriate investment entry mode and adopting advanced management of invested assets to improve target value.

In addition, investors are advised to have strong finances, expertise and experience in hospital management and a good relationship with the local government. Strategic partnerships can be leveraged to strengthen the required capabilities and form strong alliances, said the report.

liujie@chinadaily.com.cn

(China Daily 06/24/2013 page14)

Today's Top News

France wants more Chinese investment

FM: China rejects US' claim on Snowden

Public interests Party's top priority

Overseas sellers upbeat on China

PBOC will act 'if necessary'

4 Chinese killed in Papua New Guinea

'Heavy losses' if China-EU solar sector talks fail

Riots in Xinjiang kill 27

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|