China Galaxy shares in hot demand on debut in HK

Updated: 2013-05-23 09:41

By Wu Yiyao in Shanghai (China Daily)

|

|||||||||||

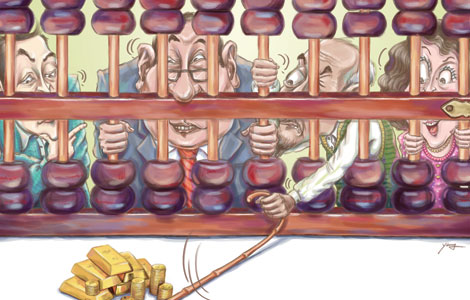

New shares in China Galaxy Securities Co Ltd were in hot demand on Wednesday, after it raised $1.1 billion in a much-anticipated Hong Kong IPO.

The shares rose 11.3 percent at one point, before ending the day up six percent on its trading debut.

The city's IPO drought has been broken by the new listing, along with that of Sinopec Engineering (Group) Co Ltd last Thursday.

China Galaxy launched at HK$5.30 (68 US cents), near the bottom of an indicative range of HK$4.99-HK$6.77 per share last week. They rallied to HK$5.90, before closing at HK$5.62.

Turnover of the stock was worth HK$2.68 billion on a trading volume of 468 million shares.

The benchmark Hang Seng Index itself was little changed, losing 0.45 percent on the day.

Analysts said the IPOs of China Galaxy and Sinopec Engineering will help meet retail investor demand for new listings in the Hong Kong stock market, and the market's liquidity may support more new listings in the second half of 2013.

"IPO issuance in Asia excluding Japan in the first quarter of 2013 was the worst since 2009, dropping by more than 50 percent year-on-year in value to some $3 billion," said Guo Jia, an analyst with Aijian Securities Co Ltd.

"The two new listings helped feed investor hunger and boost trading in the market."

China Galaxy is the sixth-largest brokerage company in China by revenue.

In 2012, its revenue was 6.4 billion yuan ($1.04 billion) with net profit of 1.4 billion yuan.

Its $1.1 billion IPO was the second-largest in Hong Kong in 2013, behind Sinopec Engineering's $1.8 billion debut listing.

Retail investor demand for China Galaxy was nearly 30 times the number of shares on offer, or "significantly over-subscribed", said the company's filing on Tuesday.

The brokerage's stock price soared as much as 8.3 percent in gray market trading on Tuesday, reported Reuters.

Hong Kong has been widely known as the global IPO hub in recent years, although deals have dropped significantly, with the $7.71 billion worth of new issuance in 2012 the lowest since 2008, according to data from Hong Kong Exchanges and Clearing Ltd.

China Galaxy hired 21 underwriters for its IPO, including Goldman Sachs, JPMorgan and Nomura.

"The number of underwriters was a record for Hong Kong's IPO market," said one Beijing-based investment banker.

"In fact, some of the 21 book runners are not making money from the deal, amid a sloppy time for IPOs in Asia, especially with the IPO channel in the mainland not yet reopened."

He added that underwriter competition for IPO deals in Hong Kong will become increasingly fierce as more enterprises from the mainland eye listings in the city this year and next.

According to ChinaVenture, the Beijing-based financial data provider, 75 enterprises of the 89 to get listed on overseas exchanges this year chose Hong Kong.

All of the 12 Chinese mainland enterprises that launched IPOs in the first four months of 2013 were listed in Hong Kong.

Today's Top News

China, Pakistan to set up economic corridor

Soldier hacked to death in London

Solar negotiations with EC fail

Special envoy from DPRK arrives

Consumers' demand for luxuries growing

Survey predicts fast growth in business travel

Consumers more willing to spend

Premier Li arrives in Pakistan for visit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|