Rising yuan increases risks

Updated: 2013-05-22 07:51

(China Daily)

|

|||||||||||

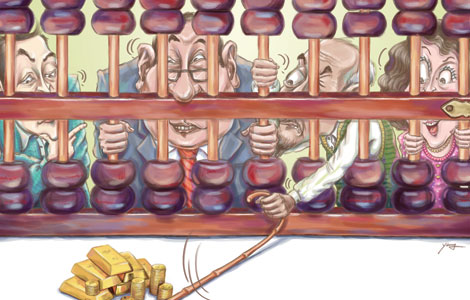

The yuan's daily reference rate set by the central bank rose to a historical high of 6.1911 per US dollar on Tuesday. Such a strong rising momentum, however, may pose risks as China's economic growth eases and capital inflows accelerate.

On Monday, the central bank also surprised the market by keeping the yuan's reference mid-point almost flat despite a rising dollar.

The yuan has risen by more than 1.5 percent against the dollar this year in terms of the mid-point rate and most of the gains have come since April. The yuan's recent trend is tricky since the dollar has been on the rise.

The market is waiting for any signal of changes in the US' bond-buying program, as hinted by a senior Federal Reserve official last week. If the US tapers its bond-buying program, it is expected to lead to a stronger dollar.

Considering China's struggling economy, the yuan's trend is puzzling. Economic activities remain at low levels, indicating it will be very difficult for the world's second-largest economy to pick up in the coming months.

Thanks to the beggar-thy-neighbor monetary easing policies of some major economies, China could easily fall victim to abnormal international capital flows given its relatively high interest rates and booming real estate market. A higher yuan will only make things worse.

Given the abnormal trade data and foreign exchange purchase by the central bank this year, economists have warned that a significant amount of speculative money may have flowed in seeking to cash in on domestic investment opportunities.

Having issued stricter rules on the management of cross-border capital flows in early May, the monetary authorities may aim to curb such inflows through heightened monitoring, thus offsetting the effect of a higher yuan. But the already accumulated speculative capital shows that it is very difficult to keep such capital away given the big potential for profiteering.

While pursuing yuan liberalization, the authorities must avoid incurring the problems caused by an influx of hot money.

Related Stories

China's trade surplus figures 'over-inflated' 2013-05-22 02:27

Yuan appreciation burdens exporters 2013-05-17 07:45

China reports five consecutive months of net forex purchases 2013-05-17 07:45

Rising yuan poses challenges for exporters 2013-05-15 05:30

New RMB loans drop in April 2013-05-11 01:59

Today's Top News

Top Chinese brands increase in value

China's trade surplus figures 'over-inflated'

EU telecom probe 'hurts interests of both sides'

China, India in talks on trade strategy: Li

Xi, Obama to meet in California

China-Japan trade will pick up

Netizens question young official's 'rocket promotion'

Severe punishments urged for air threats

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|