Investors upbeat about banks' outlook

Updated: 2013-05-22 05:36

By Xie Yu in Shanghai (China Daily)

|

|||||||||||

|

An outlet of Industrial & Commercial Bank of China in Xuchang, Henan province. The bank's share price rose 0.24 percent to 4.2 yuan (68 US cents) on Tuesday. Provided to China Daily |

ICBC's share price rises despite sale of Goldman Sachs' remaining stake

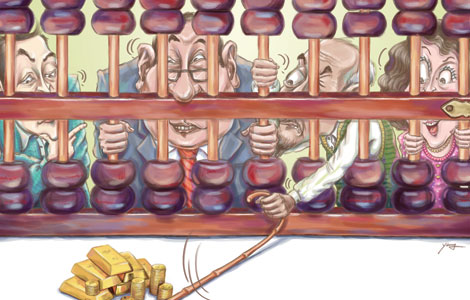

Local investors remain confident of the medium- to long-term performance of leading bank shares, despite the sale of a $1.1 billion stake in one of the country's largest banks by Goldman Sachs Group Inc.

Industrial & Commercial Bank of China rose 0.24 percent to 4.2 yuan (68 US cents) on Tuesday - against an average 0.24 percent sector decline - one day after it was announced that Goldman Sachs had sold its remaining stake in the Beijing-based bank for about $1.1 billion.

"Goldman's decision to sell was based mainly on their need to move out of stock into cash," said Zhang Qi, a senior analyst with Shanghai-based Haitong Securities.

But there are other - mainly foreign - investors who contend that Goldman, like some other overseas institutional investors, have a dim view of the prospect of Chinese banks, which they said are saddled by large chunks of doubtful loans.

Muddy Waters LLC, the short seller, was quoted by Bloomberg on Tuesday as saying China's non-performing loan figures "greatly understate the potential scope of the problem of poor-quality loans" and the country's banking system will be forced to recapitalize a number of the banks.

Zhang said that everyone realizes Chinese economic growth has slowed, and that the authorities have conducted large-scale investments in infrastructure construction over the past several years that may trigger risks in local government debts.

Today's Top News

Obama seeks new path in war on terror

Li arrives in Switzerland for first EU trip

Pyongyang 'to heed Beijing'

Lenovo posts record results

PMI points to slowdown

Many countries express interest in JF-17 Thunder

China offers to provide peacekeepers to Mali

No fast results expected from summit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|