Bad loans at four-year high

Updated: 2013-05-16 05:06

By Wang Xiaotian (China Daily)

|

|||||||||||

|

The headquarters of the Bank of China in Beijing. Major State-owned banks saw their non-performing loans rise by 14.6 billion yuan ($2.37 billion) in the first three months. [Photo/Agencies]

|

Total assets of banking sector grow fivefold in past decade

Bad loans of Chinese banks reached their highest level in four years by the end of March, according to data released by the China Banking Regulatory Commission on Wednesday, while their total assets rose by 17 percent.

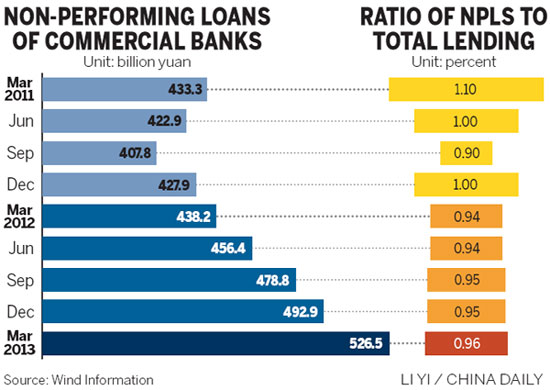

Outstanding non-performing loans, or NPLs, stood at 526.5 billion yuan ($85.67 billion), up by 33.6 billion yuan from the end of 2012, while the ratio of bad loans to total lending rose by 0.01 percentage point to 0.96 percent, during the first quarter of the year.

Total assets of the banking sector stood at 141.3 trillion yuan, meaning total banking assets have increased by 113.6 trillion yuan, or fivefold, in the past decade.

Bloomberg reported the figures also mean that bad loans have now increased for a sixth straight quarter - the longest deterioration streak in at least nine years.

The CBRC added that the provision coverage ratio for bad loans fell to 291.95 percent by the end of March, from 295.51 percent three months earlier.

Shang Fulin, its chairman, warned the bad loan levels are likely to continue rising among banks.

The soured-loan increases were reported across all categories, including State-owned lenders, joint stock banks and regional banks in cities and rural areas.

Major State-owned banks experienced the biggest jump, as their NPLs rose by 14.6 billion yuan during the quarter. Their ratio of such loans to total lending dropped by 0.01 percent to 0.98 percent.

Joint stock banks reported the biggest increase in their NPL ratio, by 0.05 percent to 0.77 percent, while the amount of their bad loans went up by 9.9 billion yuan.

Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics, said: "The rise in non-performing loans is a natural result of economic slowdown, with increasing defaults among companies, especially small and medium-sized enterprises."

However, he suggested the current increase in soured loans was still mild, and the amount may decrease in the following months, as the economy stabilizes.

An Ernst & Young report, released on Tuesday, also said that the banks' "increasing momentum to lend to SMEs for higher returns" had led to increasing credit risks, and how to fend off bad loans from this sector "has become a challenging task".

Jimmy Leung, PwC's banking and capital markets leader for China, said banks should now write off more bad loans using their profits, and put more efforts into collecting loan repayments.

The CBRC figures showed that bank profitability had declined as domestic economic growth slowed to 7.7 percent in the first quarter, and the government continued attempts to liberalize interest rates.

Net interest margins, a major measurement of profitability from traditional deposits and lending, narrowed to 2.57 percent in the first quarter among 3,800 lenders, from 2.75 percent at the end of 2012, it said.

Income based on the interest rates accounted for around 80 percent of the total income of Chinese banks last year, according to CBRC figures.

Related Stories

CDB bad loan rate at 0.31% 2013-04-23 09:55

Agency warns on bad loans 2013-04-22 17:41

CBRC to keep close eye on bad loans 2013-04-19 19:58

Bad-loan management sees changes 2013-03-05 10:44

Bad loans increase for fifth quarter 2013-03-02 09:39

Today's Top News

British visa easier to woo Chinese tour groups

Taiwan-Philippines dispute grows

Solar-grade polysilicon probes almost completed

China to increase input on the Arctic

Visa-free policy in Shanghai draws 3,800 visitors

JP Morgan cuts GDP growth forecast

China to tighten management of teachers

Telephone threats ground five planes

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|