Third-party payment firms enter the fray

Updated: 2013-05-03 07:34

By Chen Limin and Wang Xiaotian (China Daily)

|

|||||||||||

|

Alibaba Group Holding Ltd, the country's largest e-commerce company, plans to provide financing services to customers. Provided to China Daily |

Led by Alipay, a new generation of online 'banks' are now flexing their financial muscles

It's not an easy task to compete with banks, whose sheer size may be too big for latecomers to handle. But there are exceptions.

Third-party payment companies, after a decade of fast development, are providing not only payment services but also services traditionally provided by banks, such as loans.

Among these companies, Alibaba Group Holding Ltd - China's largest e-commerce company - has gone further than others. Alibaba plans to set up Alibaba Small and Micro Financial Services Group to consolidate its online payment and micro loan businesses, and provide financial services for consumers and small and micro enterprises - those with an annual turnover of less than 30 million yuan ($4.8 million).

The company has made it clear that its two main business arms will be e-commerce and financial services based on its huge e-commerce data. The latter is thought to be a challenge to banks and may change the financial industry landscape due to the use of Internet technology and the huge amount of data that records users' history and habits.

"For the past 13 years, Alibaba hasn't thought of challenging anyone, but creating something new instead," Alibaba's Chairman Jack Ma said at an industry forum late March when asked whether his company aims to challenge banks.

"Banks are getting a bit nervous. But I think that getting nervous is good, and it would be strange if they aren't," Ma said.

"If banks weren't nervous, China's small and micro businesses would be nervous," Ma added, hinting that banks fail to provide enough services to help small and micro enterprises raise funds.

Challenge to banks?

Major third-party payment companies in China first appeared around 2004, and they have quickly risen to prominence as the country's e-commerce market grew dramatically over the last decade.

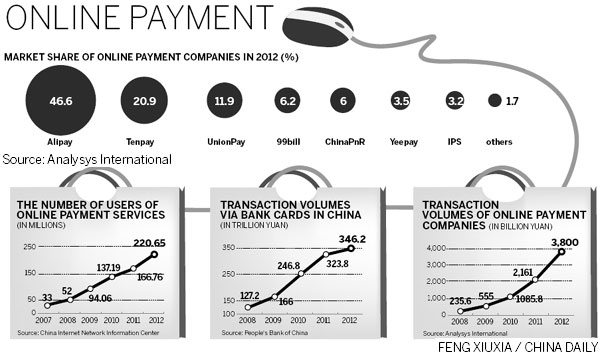

Last year, the total transaction volume processed by third-party payment companies reached 3.8 trillion yuan, an increase of 76 percent year-on-year, according to domestic research company Analysts International.

By contrast, in 2012, the total transaction volume of bank cards in China was 346.2 trillion yuan, according to People's Bank of China.

While the biggest player in the sector, Alipay, which is owned by Alibaba, originally acted only as an escrow between sellers and buyers, third-party payment companies are now offering a wide range of services, such as payment and settlement services, and micro loans.

Alibaba plans to launch a credit payment service for its mobile users, which gives them a certain credit limit based on their Alipay records.

Although banks provide the funds, the service is thought to be similar to a cyber credit card, a further move by third-party payment players to expand in the financial industry.

"I don't think the service will have an impact on the banks' credit card business. In fact, it's complementary as more users' credit histories can be dug out and accumulated for banks' reference," said Hu Xiaoming, Alibaba's vice-president.

The move comes after Alibaba started to extend loans to vendors on its trading websites based on their trading records rather than collateral in 2010.

Around 220,000 small and micro enterprises had received loans from Alibaba as of March, at an average interest rate of about 18.9 percent a year, which is "not low" for small and micro companies, said Hu.

More industry players, not only third-party payment companies but also e-commerce companies, have started providing micro loan services to ease funding problems.

Beijing Jingdong Century Trading Co Ltd, which operates China's second-largest shopping website, and smaller rival Suning Commerce Group Co Ltd both partnered with banks to provide micro loans to their suppliers and distributors, which usually face a shortage of funds due to long payment periods.

With the services, Jingdong and Suning's suppliers and distributors can get funding more easily based on their past credit and account receivables records.

This way of lending by using e-commerce data differs from the traditional way, in which small companies have to provide collateral to banks and sometimes have difficulties meeting the banks' requirements. In addition, banks usually prefer larger companies with lower risks.

"Banks are actually a bit behind. They don't have the key e-commerce data of their customers, and this may prevent them from developing value-added services as their Internet counterparts do," said a vice-president at a major third-party payment company who asked not to be named.

He Qiang, a professor at the Central University of Finance and Economics, said that the expansion of third-party payment and e-commerce companies into payment services may pose a challenge for banks.

"Payments are where banking services start, as clients deposit their money in the banks primarily for the purpose of processing payments, which generates lending and remittance business. And now the online payment companies are taking the same track," he said.

Innovation encouraged

However, Simon Chow, head of the consumer banking unit at Citi (China) Co Ltd, said that banking products and services, such as credit cards and electronic banking, are still irreplaceable despite the fast development of third-party payment services.

"Banking services provide clients with complex possibilities, such as cash flow management, instead of payments alone. In addition, the way the banks and companies control risks and serve their clients are quite different," Chow said.

Zhou Xiaochuan, the central bank governor, said on March 13 that authorities support the financial innovation of the e-commerce players.

"The challenge they pose to the traditional banking model is beneficial, as fiercer competition will promote the development of the banking industry, with better products and services," Zhou said.

But the development has put pressure on the existing regulation system, as policymakers haven't fully adapted to the changes.

"Regulators are also highly concerned of the financial risks the new developments might trigger," Zhou said.

He said that not only the lenders, but also regulators need to step up to the challenges and speed up their adjustment to the new environment by upgrading regulatory rules.

He Qiang said the boundary between e-commerce companies and banks is increasingly blurring, and there's a trend whereby those companies get more involved in financial services by establishing banks themselves or holding more shares in existing commercial lenders.

"It would be natural for the lending firms under the flagship of e-commerce companies to turn into a commercial bank, if they keep a sound profit record. The current legislation allows that possibility. It's only a matter of time," He said.

However, Alibaba's Hu said the company will not become a bank, dismissing rumors that it will apply for a bank license.

Meanwhile, financial institutions, such as banks and securities companies, are also exploring Internet technology and developing electronic banking businesses, and even e-commerce platforms as a response to the growing competition, said Ma Weihua, president of China Merchants Bank Co Ltd.

For instance, CMB launched a shopping website for its credit card users in October 2004.

The bank has also set up an e-commerce company in Shanghai to provide travel services such as flight and hotel bookings.

The next step will be to sell luxury goods online, as the lender tries to differentiate itself from regular online malls, said Ding Wei, a vice-president at CMB.

"Banks have advantages in selling expensive and luxury goods online compared to other e-commerce companies, due to their better reputation and credibility. It's very important for lenders and e-commerce platforms to find out what they are good at," Ding said.

Ding added that the premier goal of banks when they set up shopping platforms is to stabilize relations with clients, instead of just seeking profits like e-commerce platforms.

In 2011, the transaction volume of the bank's online mall exceeded 700 million yuan. The lender expects sales to reach 10 billion yuan in the next three years.

Another major lender, China Construction Bank Co Ltd, started its e-commerce business, e.ccb.com, in June 2012, becoming the first Chinese bank to offer e-commerce services.

The move came after an unsuccessful cooperation project between CCB and Alibaba in 2007: Alibaba complained that the bank was overcautious when extending loans to companies, while CCB indicated it couldn't get enough data on companies from Alibaba.

After half a year, CCB's platform reached a transaction volume of 3.5 billion yuan with more than 10,000 registered stores.

Pang Xiusheng, vice-president of the bank, said it would never charge rents, commissions or advertising fees for stores on its online platform, and that the lender expects profits from services such as online loans and secured transactions, instead of the price differentials of the goods.

Other banks such as China Minsheng Banking Corp and China Citic Bank also plan to launch similar e-commerce platforms this year.

Credibility is the banks' biggest advantage when developing e-commerce businesses. In addition, they have strong capital strength to support them, said He.

He said existing bank operations such as settlement, clearing and credit services, as well as their IT infrastructure and outlets, will set a sound foundation for the lenders' exploration of e-commerce.

Contact the writers at chenlimin@chinadaily.com.cn and wangxiaotian@chinadaily.com.cn

(China Daily 05/03/2013 page17)

Today's Top News

China's automaker to open 1st US plant

Two preschool girls die from poisoning

Academic elected into US science academy

Beijing acts on complaints against airport cabbies

Military denies expensive vehicle had new plate

Police in major crackdown on tainted meat

Joint fund on hunt for investment opportunity

A-share firms' overall profits flat-lining

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|