Brewing up the right recipe for success

Updated: 2013-03-21 07:33

By Wang Zhuoqiong and Xie Chuanjiao (China Daily)

|

|||||||||||

Domestic battlefield

For other businesses, going global involves expanding beyond their borders but for breweries China is the main battlefield, said Sun.

"It is not sensible giving up such a great market and competing in the saturated markets of developed countries," he said.

At work, Sun has two principles: "Never miss a major opportunity; never ignore a major threat." Failure regarding either of them would create trouble or even be fatal for the company, he said.

The sense of threat comes from a true and deep understanding of the Chinese market, Fang said, and an awareness of the large gap between local and foreign breweries.

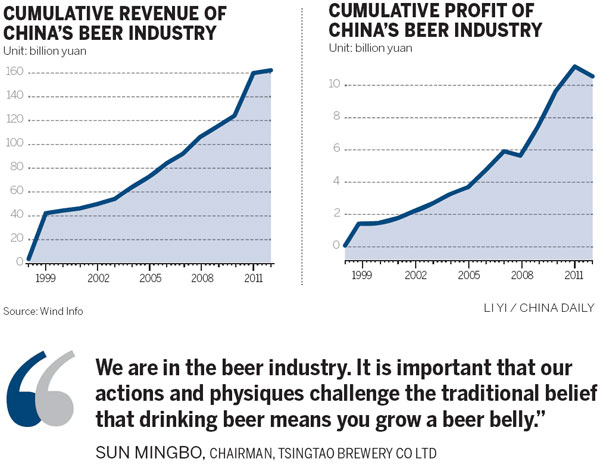

After decades of expansion through many acquisitions, the Chinese beer industry is dominated by three domestic brands: China Resources Snow Brewery, Tsingtao Brewery and Yanjing Brewery, as well as three foreign brands - Anheuser-Busch InBev, SAB Miller and Carlsberg.

Anheuser-Busch InBev had a production volume of 5.59 million tons in 2011 and has plans to invest 20 billion yuan in building eight to 10 new manufacturing bases in China to achieve its goal of 15 million tons, Fang said. That's equivalent to more than 30 percent of sales in China.

On the domestic front, Tsingtao, although it is equipped with a strong mixture of local and national level brands and has 60 breweries in 19 locations, has strong rivals.

With 80 breweries and a 21 percent market share, the largest beer manufacturer by production volume is China Resources Snow Breweries. It is a peer of China Resources Enterprises Ltd and the world's second-largest brewery SAB Miller, and experienced sales growth of 5 percent in the first three quarters of 2012 of 9.06 million kiloliters.

The third-largest brewery, Yanjing Brewery, which is focused on a local strategy and has a 12 percent market share, grew 0.77 percent in the same period.

Sun said he believes the market could be further developed and competition lies in the capacity to execute new business models and raising operational efficiency.

"In the past, you only had to run fast. Now you have to run while making yourself really strong at the same time," he said.

Tsingtao's next move is to expand market share and raise sales volumes in central and western regions because the eastern market is saturated.

As for its global market, Tsingtao sells to more than 80 countries and regions and is expanding. Sun said its global presence is aimed at building a high-end brand with products that are among the most expensive.

Related Stories

Tsingtao Beer to open brewery in Thailand 2011-10-18 15:27

Tsingtao, Suntory brew JVs to expand 2012-06-07 10:41

Tsingtao brewing up overseas ambitions 2012-01-10 10:46

Tsingtao reports slim growth in H1 2012-08-16 22:04

Tsingtao Brewery Co H1 profits jump 22% 2011-08-18 10:14

Tsingtao Brewery 2010 net profit up 21.6% 2011-03-31 10:02

Today's Top News

Police continue manhunt for 2nd bombing suspect

H7N9 flu transmission studied

8% growth predicted for Q2

Nuke reactor gets foreign contract

First couple on Time's list of most influential

'Green' awareness levels drop in Beijing

Palace Museum spruces up

Trading channels 'need to broaden'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|