Small firms' last resort for financing

Updated: 2013-01-21 10:09

By Yu Ran in Shanghai (China Daily)

|

|||||||||||

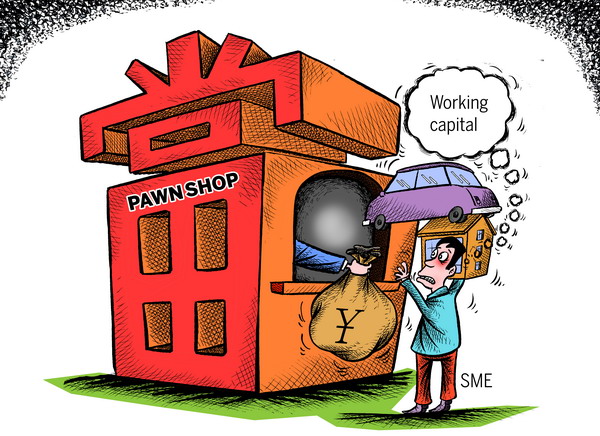

Many private business owners turn to pawnshops to find alternate funding options

After knocking on several doors, Wu Xiang finally raised the money required for urgent business expenses from a pawnshop in Tianjin by pledging his more than 2 million yuan ($321,000) Porsche Panamera as collateral for a cash loan.

Though the monthly interest of 4 percent on the 1.5 million yuan loan is steep, Wu, the 34-year old owner of a small trading company in Tianjin, says he has no regrets in pledging his prized car as "profit margins are shrinking and there are virtually no other financing avenues."

|

Many small and medium-sized enterprises' owners went to pawnshops and mortgaged their cars for short-term loans during the year-ending period. SMEs are increasingly facing a working capital crunch, as banks are reluctant to lend to them due to their poor business record. [Photo / China Daily] |

Wu, is not alone in his predicament as several small and medium-sized businesses in China are struggling to find alternate financing options to stay afloat especially in the November-December period.

Like Wu, many of the small and medium business owners are now increasingly turning to pawnshops, so much so that they have become an integral part of China's modern financial landscape.

"I urgently needed 1.5 million yuan to make the balance payments to my business partners, pay a final loan amount to the bank and for the salaries of my employees before the end of the month," Wu said.

Having said that, Wu adds that he would redeem the prized car as soon as he gets alternate financing from a bank. He says that this is not the first time that he has had to trade in his belongings for short-term funds as he had earlier pledged his apartment for a two-month loan of four million yuan in 2011.

Unlike the loan procedures in financial institutions, which normally take up to a month for approval, pawnshops often offer instant money. The process usually consists of pledging the assets along with the related documents at a pawnshop.

"I needed to solve my financial problems within two weeks, and pawning the car was the quickest and easiest way to raise funds," said Wu.

Traditionally, people pawned clothes, antiques and valuables like gold, silver or jade at pawnshops. However, in recent times Chinese pawnshops have become much more diverse and seen assets like real estate, private cars and equity shares being pledged for quick money.

"Efficiency, convenience, flexibility and customized service often make pawnshops the most preferred financial channel for individuals and enterprises," said Yang Yong, the manager of the automobile business department at the Huaxia Pawnshop in Beijing.

Huaxia has grown to become one of China's biggest pawnshops since its launch in 1993 and currently has over 20 branches in Beijing.

"People are no longer going to pawnshops for survival, but consider it a viable option to deal with emergencies," Yang said.

Latest reports

SMEs gain greater access to funds

APEC economies vow to boost SME development

Small, micro firms struggle with dip in overseas orders, cash-flow woes

Monitor cash flow to control SMEs loan risks: experts

SME confidence slips again in Q3

Performance to determine SME funding applications

China SME Global Development Forum held in Austria

Find more in

Related Stories

Banking on sound strategies to overcome challenges 2012-11-16 14:42

SME manufacturers hammered by European economic slump 2012-08-16 11:06

China ready for SME private placement bonds 2012-04-06 01:13

Wenzhou needs a change of tack 2012-12-13 13:30

SME business confidence edges higher 2013-01-08 23:03

China's support for small businesses praised by Arab youth council 2012-11-22 14:27

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|