Private banking for rich 'faces golden era'

Updated: 2012-12-24 09:48

By Wu Yiyao in Shanghai (China Daily)

|

|||||||||||

In Wuhan, capital city of Hubei province, the wealthy are applauding the newly opened private banking service offices around the town.

"It's much easier visiting the offices in town than flying to Beijing or Shanghai - I used to fly to Beijing twice a week for a month to find a reliable wealth manager. Now I don't need to bother with that," said Qin Weiguo, a garment wholesaler.

Qin, 52, declined to reveal how much money he put in his private banking account at a State-owned bank. However, he said it was a seven-digit number.

He said before 2012, he was rejected by several banks when he applied to become a client of their private banking services.

"They politely told me that my money was not enough because the entry level of wealth was 10 million yuan," said Qin.

The situation changed on Jan 1, when regulators set a national standard for domestic private banking services of commercial banks providing to individuals with a wealth of 6 million yuan or more.

"The benefits of having private banking services are multiple, among which I like the seminars most," said Qin.

The seminars Qin mentioned are not only about investment strategies.

"The experts my manager invites me to may talk about tea tasting, calligraphy, stamp collections and antique appreciation, most of which are very interesting," said Qin.

Second-tier cities in China already represent more than 30 percent of the country's HNW individual wealth, compared with about 20 percent for first-tier cities. Second-tier cities in the Yangtze River Delta Region (including cities such as Wuxi, Nanjing and Hangzhou) and the Pearl River Delta Region (with cities such as Dongguan, Guangzhou and Foshan) represent about 70 percent of China's HNW individual wealth. Second- and lower-tier cities will continue to grow in share, said the Minsheng and McKinsey survey.

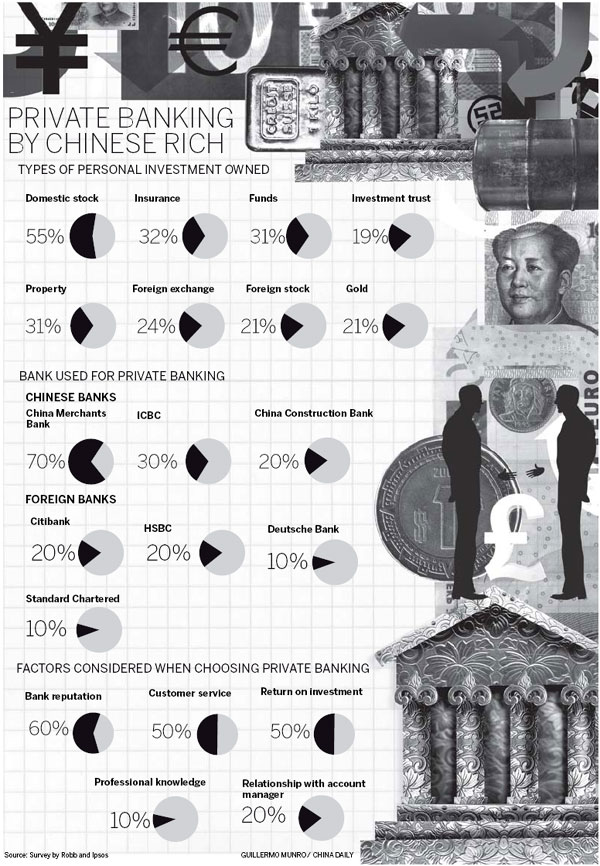

The survey, which polled 700 interviewees with investable assets of more than 6.5 million yuan in 29 cities, also discovered the average Chinese HNW individual is still not aware of private banking services. As many as 45 percent of those interviewed say they have only a basic understanding or less of private banking services.

"I think private banking services are no different from retail services. It is just the same bank offering the same products to different people. If you have more money, they will give you more benefits, such as an expensive ticket to a concert," said Chang Li, a 42-year-old restaurant owner in Ningbo, in East China's Zhejiang province.

"I think the VIP banking services are enough for me and I don't need anything extra, or a free gift during Spring Festival," said Chang.

Related Stories

BOC to sell its private bank unit in Switzerland 2012-07-25 02:08

Tibet's first private banking service opens in Lhasa 2011-09-19 21:30

Default exposes risks in wealth management market 2012-12-08 17:23

Banks' wealth management products have growing risks: Fitch 2012-12-05 21:56

Wealth managers downplay possibility of hard landing 2012-04-23 13:14

Wealth management market to expand 2011-12-23 09:15

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|