Diageo in high spirits as sales soar in China

Updated: 2012-12-08 09:20

By Liu Jie (China Daily)

|

|||||||||||

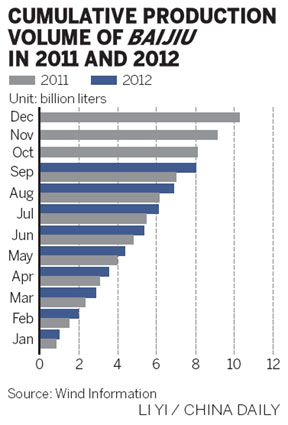

Diageo Plc, the world's largest spirits maker, is expecting its high-end liquor sales in China to continue growing 50 percent or more annually over the next three to five years, it said on Friday

The company, which owns global brands such as Johnnie Walker Scotch whisky, Smirnoff vodka, and the Irish dark beer Guinness, said it's planning to buy more high-end Chinese spirit brands, or baijiu, after taking control of Sichuan Swellfun Co Ltd in April.

Joseph Tcheng, managing director of Diageo Greater China, said future Chinese targets were likely to be top quality baijiu brands, with long histories, good distribution networks and talented managements who would fit in well with the company's global network.

"The acquisition of Swellfun matched all these requirements," he said, adding that Diageo has started promoting the product in 42 international airport duty-free shops, on seven international air routes, and in overseas markets, including the United Kingdom, Singapore and Australia.

Diageo increased its stake in the 600-year-old Swellfun to 53 percent from 49 percent in April.

"We believe high-end baijiu broadens our product portfolio in China," Tcheng said. "Imported spirits are usually enjoyed in night clubs and bars, while baijiu is served with food. One of our business focuses is to start introducing our spirits to the dining table market."

Various alcohol producers are under investigation in China after an independent food testing company found that some bottles of baijiu allegedly contained toxic plasticizers that pose various health risks including cancer.

But Tcheng insisted that high-end products "with good reputations and management systems" will not be affected by the issue.

Gao Li, a beverage analyst with Hua Chuang Securities Co Ltd, said the plasticizer scandal may create opportunities for reliable, imported spirit brands.

"On the other hand, more young people and consumers with overseas experience are already likely to have more interest in cognac and whisky," he added.

According to Diageo research, nearly half of China's alcoholic beverage market - valued at around 420 billion yuan ($67.41 billion) in 2011 - is occupied by the local fiery-grain spirit, with beer accounting for 30 percent and wine holding an 8 percent share.

"Imported spirits only make up less than 2 percent, implying high potential," Tcheng added.

The company's turnover in China increased by 16 percent year-on-year during the year ending June, while sales of high-end spirits were up more than 50 percent, compared with double-digit growth for its business in general.

The company expects that 50 percent rate to continue, as it invests more in its quality brands, aimed particularly at China's high-spending, burgeoning middle class.

Diageo is also trying to promote its luxury spirits as gifts at important festivals in China.

"Some of our products are leading their individual brand markets," added Tcheng, citing Scotch whisky brand Johnnie Walker as an example, which makes up 30 percent of China's whisky market by volume.

According to a recent report by Frost & Sullivan, a US-based market consultancy, consumption of alcoholic drinks in China is expected to reach 84.37 billion liters in 2016, which represents an average annual compound growth rate of 5.9 percent from this year.

"The market share of imported high-end spirits (in China) is still very tiny, so there is room for everyone," said Tcheng, adding that Diageo is the first international company to acquire a baijiu brand.

On Friday it opened its latest "experience center", Johnnie Walker House - a high-end whisky cultural promotion and experience outlet, in Beijing.

liujie@chinadaily.com.cn

Related Stories

Diageo buying another round 2011-06-29 09:28

Ministry OK's Diageo takeover of local liquor company 2011-06-28 09:15

Liquor trusts hit by plasticizer scandal 2012-12-03 15:31

Scandal-hit liquor maker halts packaging lines 2012-11-28 09:53

China probes liquor containing excessive plasticizer 2012-11-22 14:12

Ups and downs of Chinese liquor industry 2012-11-21 17:26

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|