Outsourcing's trials and tribulations

Updated: 2012-11-12 09:27

By Wei Tian (China Daily)

|

|||||||||||

As the number of companies increase, vendors' bargaining positions weaken because everyone is offering lower rates. "It is difficult for them to pass on the rising labor costs to the clients so the vendors' margins drop," Liu said.

Although the number of employees and the size of revenues continue to expand, outsourcing companies now face lower profit margins from a peak of 30 to 50 percent to less than 10 percent.

One consequence is an increase in the number of people changing jobs, as Yang did. In recent years, China's outsourcing companies have had to deal with losing more than 30 percent of their employees a year. In some companies the proportion is higher than 50 percent, although new faces can quickly fill the vacancies.

"At least half of the enterprises still rely on the head-count model. They will probably be eliminated by the reshuffle within the industry if they don't adapt to the changes," Liu said, adding that his company is shifting its focus from the expansion of its business scale to the pursuit of a sustainable business model.

Some companies have chosen to confront the difficulties by merging, such as the one between Vanceinfo and HiSoft Technology Intl in August, which created the largest offshore IT services provider by revenue in China.

The economy of scale created by the merger is expected to save 65 million yuan in administration costs a year, and therefore lift the profit margin by 2 to 3 percent, according to a report in 21st Century Business Herald. That would be a significant improvement in an industry where the average profit margin is 10 percent.

However, the market responded to the strategy negatively. Shares of Vanceinfo on the New York Stock Exchange dropped as much as 13 percent the day after the merger was announced, while those of HiSoft fell 7 percent on the Nasdaq.

"We see more companies striving to cut their costs as they face difficulties but the key to this issue lies in identifying new opportunities and increasing the value created by each employee," said Qian Fangli, director of the China Outsourcing Institute, which is affiliated to the Ministry of Commerce.

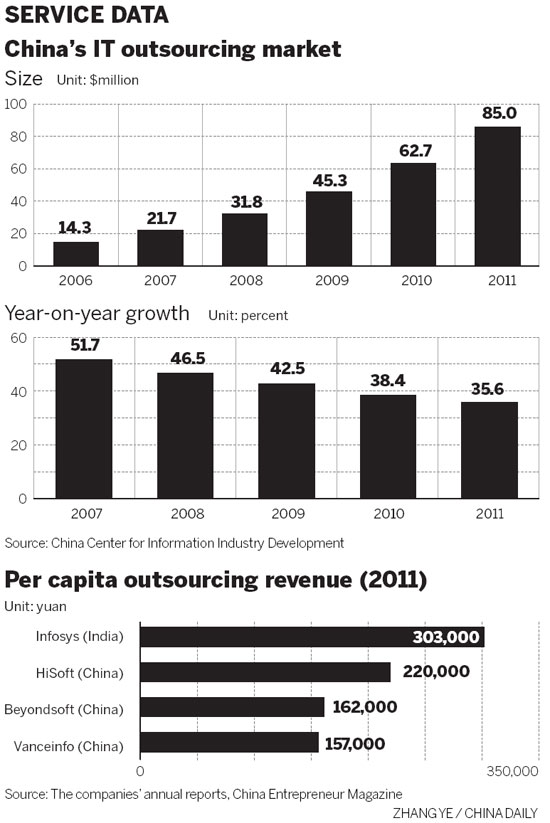

In terms of the annual revenue per capita in 2011, a Vanceinfo employee would generate less than 160,000 yuan a year. HiSoft employees were a little bit more productive but it was only slightly more than 200,000 yuan, a figure considered to be the cut-off point for Chinese vendors when the size of the company reaches a certain level.

Compared with their Chinese counterparts, employees of Indian outsourcing companies have a much better time. At Indian firm Infosys Ltd, a world leading outsourcing company, although the number of employees exceeds 150,000, the revenue per capita is around $50,000 a year, twice as much as that at average its Chinese counterparts.

While China's vendors struggle with a profit margin of 10 percent, Infosys maintains a profit margin of 25 percent.

Gap with India

Unlike the upcoming cold winter for the outsourcing industry in Beijing, things are still warm down south in Shenzhen, Guangdong province.

Larry Chen has enjoyed the opposite experience to Yang. After leaving his former post at IBM, Chen joined the Tata Group, an Indian communications and IT giant this June to become an "insecure" IT engineer in one of the company's outsourcing centers based in Shenzhen.

Currently working on a project for a world-class investment bank in Hong Kong, Chen travels to the Special Administrative Region, which is just a few kilometers away, on a regular basis and deals with issues occurring within the client's system and operating processes.

"There is no such thing as 'head-counting' here in Tata. We're all working as a team with our client on a project basis," he said, adding most of his job is completed in the Shenzhen office unless he is wanted in Hong Kong.

Chen's basic salary is 14,000 yuan a month. It is nowhere near what his co-workers in the team on the client's side earn but, taking into account overtime rates and other bonuses, Chen's income is very competitive for someone with five years of experience.

"Plus we don't have to work night shifts at all," said Chen, adding the majority of his company's clients are Hong Kong-based financial institutions.

"The fundamental difference between Indian and Chinese companies is Chinese companies are still 'people-based', whereas Indian companies have become 'package-based'," said Ramgopal Natarajan, head of the delivery, consulting and systems integration services of Infosys China.

"When you buy IT outsourcing from an Indian company, you don't just buy people alone. You buy methodologies, tools and technology that support the efficient delivery of this IT service and the knowledge gained over a period of time, the best practices we have tailored for an individual company."

Although China had already become the second largest offshore-outsourcing vendor globally in terms of contracted volume in the first half of this year, Qian Fangli said she wasn't optimistic the country could catch up with India in the short term.

More than 90 percent of the outsourcing companies in China are small enterprises and only 22 of them executed more than $100 million offshore contracts in 2011. In comparison, India had 86 companies of such a scale early in 2009, among which nine reported more than $1 billion in annual output.

"Indian companies are more recognized globally, not only on the technical side but also for their quality certifications," said Ren Hongbin, a senior researcher with the Chinese Academy of International Trade and Economic Cooperation.

There are more than 100 Indian companies that have reached level four or above in what is known as the Capability Maturity Model, a universal evaluation standard for software makers. Fewer than 20 Chinese companies have garnered such an accolade.

According to Ren, US companies won't even consider awarding a contract to an outsourcing company below CMM3. Level five is the highest.

Chinese companies started receiving global work only in recent years and have the disadvantage of language barriers so their business is still at the lower end of the industrial chain, Qian said.

However, she said, domestic companies may find opportunities with the reform of China's financial system.

Related Stories

Outsourcing to gain boost from domestic demand 2012-11-01 14:11

Outsourcing from cradle to grave 2012-10-29 15:30

Service outsourcing industry thrives in Xiamen 2012-10-12 10:02

Economic downturn benefits China's service outsourcing 2012-09-25 20:24

Govt to support services outsourcing firms 2012-09-26 20:32

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|