Lifting the lid on the next big things

Updated: 2012-11-01 13:39

By Gao Yuan in Los Angeles (China Daily)

|

|||||||||||

|

|

|

An international information technology exhibition in Beijing. Intel Capital, the venture capital arm of Intel Corp, has invested about $650 million in more than 100 Chinese technology companies since 1998. [Photo/China Daily] |

Intel executive says voice commands are the future of computing

Arvind Sodhani has been hosting journalists in a small meeting room in a resort hotel in Huntington Beach, California, for two hours.

Despite the lure of a 14-kilometer sandy beach famous for its surf just outside, the executive vice-president of Intel Corp and president of Intel Capital decided to spend most of his time with investors and the media.

Looking tired when the last group of Chinese reporters entered the room, the 57-year-old was still able to save some of his energy to discuss Chinese information technology startups.

"Chinese entrepreneurs are probably savvier than most others elsewhere in the world," he said. "They are highly motivated, very hardworking, very results-oriented and very financially oriented."

As the head of Intel Capital, the strategic investor and merger and acquisition arm of multinational semiconductor chip maker Intel Corp, Sodhani's job is to help Intel find potential partners or technology providers.

Intel Capital's investment scope includes hardware, software and services targeting enterprise, digital media, mobility, consumer Internet, semiconductor manufacturing and clean-tech sectors.

The company has invested about $650 million in more than 100 Chinese technology companies since 1998.

Sodhani said Intel Capital was the first venture capital investor in China and it helped the Chinese government to "modify many laws" to facilitate the concept of investing. Early entry helped Intel Capital build a brand name very well known to Chinese companies.

He said he believes that China is big enough to establish a standalone ecosystem in the IT industry. For startup IT companies in China, success means deep localization in the country.

"In computer and telecommunications areas, China is the largest market, so the need to go overseas is not as strong as other emerging markets," he explained.

"A startup company in the Czech Republic or Israel has to go overseas to look for a bigger market but, for Chinese companies, the domestic market is big enough for them to cultivate. Even when China is slowing down, its GDP growth is still 7 or 8 percent, so the need to go overseas is very low," Sodhani added.

On Oct 3, Intel Capital announced about $40 million of investment in 10 companies. The investment included two Chinese mainland startups: Transmension Technology Ltd, a television-focused gaming service provider, and UUCun Information Technology (Beijing) Co Ltd, a mobile advertising agency.

"Although China's TV gaming industry remains young, I believe the user base will expand rapidly as more Chinese families start to watch digital cable TVs," said Joey Pan, CEO of Transmension.

A total of 50 million TVs were sold in China last year, creating a turnover of 200 billion yuan ($32 billion), industry insiders said.

"The Internet is an ever-changing industry which requires every company to keep its products updated," said Liang Hancheng, co-founder and CEO of Fashion Republic, China's first fashion product search engine.

In January, Intel Capital announced it was investing in Liang's website along with local venture capital company, Taishan Venture Capital Co Ltd. The exact investment amount was unclear.

Liang said it does not matter who invests in his business. However, to Richard Hsu, managing director of Intel Capital China, all that matters is which companies to invest in.

"With the rapid evolution of the digital media landscape, it is critical for healthy ecosystems to be developed to support these new consumption models and enhance the consumer experience," said Hsu.

Currently, Hsu and his six-man team are in charge of a $500 million fund for the Chinese mainland and Hong Kong. The fund was put into use in April 2008.

Intel Capital's strategy gave Hsu and his team more freedom in selecting companies in which to invest.

"Our team is familiar with the landscape and understands Chinese entrepreneurs. All our investors in China are Chinese, Chinese speaking. They know China, they have been around in China, so we are not foreign investors," he said.

Every investor hopes to keep the valuation of a target company as low as possible. Intel Capital is no exception.

Sodhani and his China team came to a consensus earlier this year that most Chinese tech companies were overvalued. A moveable valuation is not good for anybody, he said.

"It is not good for the investors and not good for the companies because most of the time high valuations lead to down runs," he said.

"Over-valuations are dangerous. We try not to invest in companies with excessively high valuations."

Starting this year, Intel Capital has slowed its pace in investing in Chinese companies because of increasing risks and "irrational" company valuations.

As the company is investing as a part of Intel's overall investment strategy, Sodhani and his team were ordered to focus on areas that are important to Intel. Those include mobility, cloud computing, software services and market expansion.

"We expect a very high rate of return from our investment, so all our investments are made with two focuses. One is strategic relevance to the corporation. The other is the financial reliability of the return," said Sodhani.

"We are pursuing the strategic objectives of the corporation but we are very careful from the financial perspective. We only do deals that make sense," he added.

In addition, Sodhani doesn't think prudent investment moves would hinder Intel Capital's presence in China. From his point of view, Intel Capital can be a "very patient investor" and not just seek short-term profit.

Although China has a huge market and is now the world's second-largest economy after the United States, Sodhani said the nation still has a long way to go before it can catch up with the US in terms of entrepreneurship and technological innovation.

"We will not put 50 percent of our investment pot in China because it does not have enough companies for us to invest in. Every country is at its own stage of development," he said. "Silicon Valley is the cradle of startups. There are maybe 50 startups there every two weeks."

The Chinese government has made "an enormous effort" to encourage innovation and entrepreneurship, Sodhani added.

"I think it has done more than any other country, including the United States, to spur innovation. However, it will take time for Chinese cities to become the next Silicon Valley because it requires an ecosystem," he said. "My suspicion is that Chinese companies may start looking and speculating, and they will start to go overseas when the growth rate slows down dramatically, and that's maybe 20 years from now."

Intel Capital's investment in China is significantly higher than in other emerging markets. The company set up a $250 million fund in India, a country famous for its electronics and manufacturing industries. The sum is less than half of its investment in China.

"When the current fund is exhausted we will announce another fund in China," said Sodhani, without elaborating.

Shortly before his meeting with global media, Sodhani predicted voice control technology will be Intel Capital's next investment priority. He gave a demonstration of Dragon, Intel's newly developed voice control system similar to Apple Inc's Siri, showing an audience how to use it to search the Internet, browse Web pages and even play a Gangnam-style video.

Voice-control technology will not only be a trend for Intel Capital. It will be a mega trend for virtually everybody, he said.

"Voice is not like a mouse or keyboard. The amount of computing it requires - even the simplest instruction made by speech - is huge," he said, adding that Intel Capital is looking for companies that will solve issues surrounding speech commands.

gaoyuan@chinadaily.com.cn

Related Stories

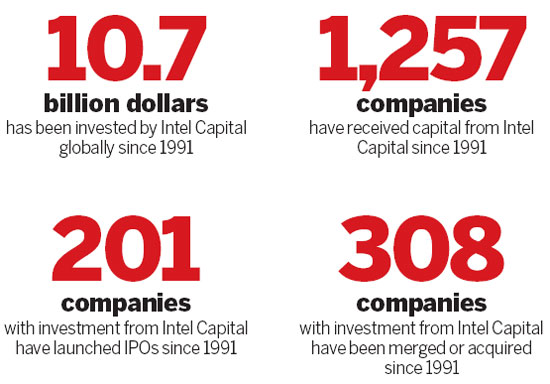

Intel's investment strategy 2012-11-01 14:09

Intel to invest in 2 Chinese tech firms 2012-10-06 05:08

Intel inside Chengdu 2012-04-20 11:14

Lenovo to launch first smartphone with Intel chip 2012-04-12 10:18

DPRK launch an intel opportunity for US, allies 2012-04-06 09:23

Intel Capital hopes to maintain investment momentum in China 2012-03-29 07:49

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|