Getting down and dirty

Updated: 2012-06-08 10:42

By Zhong Nan (China Daily)

|

|||||||||||

|

China's agricultural industries offer business opportunities for both domestic and foreign companies amid the rising demand for food in China. Provided to China Daily |

More domestic and international companies are investing in agricultural industries

With more than 1.3 billion people to feed and expectations that demand for grain, fruit, vegetable, seafood, meat, dairy and beverage products will increase at least 10 percent every year for the next five years, China's government is placing a high premium on developing agricultural industries.

| ||||

Fortunately there is an increasing number of international and domestic companies, some of which until recently were never in the agriculture business, that have begun to expand their investments in livestock breeding, dairy production, creating sweeteners and manufacturing other food products to meet the soaring domestic demand.

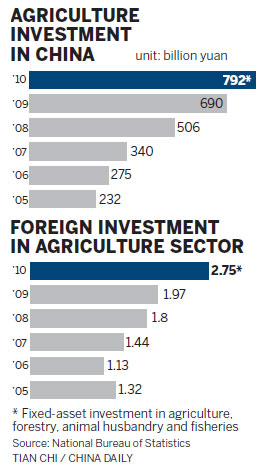

According to a report on investments in China's agricultural industries by Deloitte China, total investment in the nation's agricultural industries reached $2.56 billion between 2006 and 2011. The figure in 2011 alone was $1.1 billion.

The Deloitte report says food prices in China will continue to rise because of higher labor costs and poorer farm production, further taking a bite out of consumers' wallets.

Faced with those two major factors, foreign and domestic companies are finding major opportunities to expand their businesses in China. Nestle S.A., the world's largest nutrition, health and wellness company, is one prime example.

Founded and headquartered in Switzerland, the company sees major potential in the dairy market and vows to increase the quantity and quality of its milk produced in China in light of numerous milk scandals over the past few years.

Roland Decorvet, chairman and CEO of Nestle (China) Ltd, says the company currently has three dairy plants in Shuangcheng, Heilongjiang province; Ergun, Inner Mongolia autonomous region; and Qingdao, Shandong province.

Last month, Nestle signed an agreement with a county government of Old Barag Banner in the Inner Mongolia autonomous region to build a new dairy farm. The county government confirmed that it has signed a memorandum of understanding with Nestle to build a 2,000-cow dairy farm by the end of 2013 near the Hulunbuir grasslands, not far from Nestle's dairy plant in Ergun that was built in 2007.

According to the agreement, Nestle will not have ownership of the farm, but will help in operations. The company will collect milk from more than 25,000 farmers and herdsmen on its farm in Ergun to use in its dairy products, such as milk powders and creams.

Decorvet says the economic environment is changing quickly in China and in order to ensure the quality of its milk products, the company's dairy farmers will be given further training in safety standards.

In January, Nestle announced it would invest 2.5 billion yuan ($392 million, 316 million euros) over the next five years to train diary farm managers. The money will also be spent to operate its dairy farm in Shuangcheng and improve the milk quality there.

"We are moving toward more middle and large size farms. We are building a large dairy farming institute in Shuangcheng and we will teach the farmers to manage cows up to 5,000 as a business model," Decorvet says.

Nestle also has 32 factories in China producing instant coffee products, baby food products and bottled water with a total number of 45,000 employees.

Cargill Inc, the world's largest animal nutrition and agricultural products manufacturer that is based in the United States, has also begun expanding its investments in China.

Robert Aspell, president of Cargill Investment (China) Ltd, says the company intends to invest more in the sweetener business in Dongguan, in South China's Guangdong province.

"There is still a big supply gap for sweeteners in the Chinese market. The sweeteners will support China's needs for producing confectionaries, coffee creamers, beers, dairy products and beverages," Aspell says. "The sweetener products will be in small packages to meet the government's requirement on food safety."

In February, Cargill established a sweetener manufacturing plant in Luohe in Henan province in a joint venture with longtime partner Coca-Cola Co. With a combined investment of $86 million, the manufacturing facility is expected to be operational in December.

Coca-Cola recently added $200 million to support its expansion in China's central region and invested another $4.7 million to establish an automated warehouse in Luohe.

Aspell says that any agricultural investments must be adapted to regulations in China.

"In term of investments in agriculture, we see it continuing in China. But the agricultural world is not flat in terms of access to finance, land ownership, technology and information, simply because the demands in different geographical locations are different," he says.

Cargill (China) also has a feed factory in Dongguan with an investment that exceeds $200 million. The company plans to produce more agricultural products such as processed palm oil and creams this year.

Cargill's global sales and revenues reached $119.5 billion in 2011 with $2.69 billion in profit. The company's investments in China accounted for 15 percent of its total global investments last year. Cargill (China) currently has more than 7,000 employees across China at 47 plants.

One surprising turn of events from the government's plan to attract more companies to invest in agriculture has been the rise of corporations which previously had no hand in food products.

Wuhan Iron and Steel (Group) Co, or WISCO, is one of China's largest iron and steel makers and is based in Central China's Hubei province. Deng Qilin, general manager of WISCO, says that because the company has been affected by a shortage of iron ore and rising costs in logistics, it is putting more eggs in the agricultural basket. With a focus on wine, pork and vegetables, the company's highest aim is to build a farm that can hold 10,000 pigs in Wuhan this year.

"Our company is at an inflection point in the market," Deng says. "Even though steel production in China has increased over recent years, the margin (of profit) has slumped to less than 3 percent, far below the 6 percent registered by the industrial sector."

Deng adds that "the price of one kilogram of steel thread is cheaper than 200 grams of pork" and that with "a growing need for agricultural products our goal is to gain more money from agricultural sectors".

Since last year, WISCO has increased investment in non-steel businesses such as catering services and trading. This sector has created nearly 2.1 billion yuan in profit, accounting for 60 percent of the company's annual profit. Deng says this line of business has helped the company gain a 17.4-percent growth in profit.

The steelmaker is investing 39 billion yuan in non-steel businesses this year. WISCO will build vegetable and pig farms in Wuhan. Deng says the company is also ready to tap the agricultural logistics business by providing services to urban residents such as deliveries of vegetables and possibly meats.

"Over the next five years, the non-steel business will take 30 percent of company's output value. The agriculture investment would become a big part of it," Deng says.

Another Chinese company, Legend Holdings Ltd, parent company of the world's second-largest PC maker Lenovo Group Ltd, is also keeping a close eye on the nation's agricultural industries.

The company established its agricultural business department in 2010. The department's first target are fruits. It has established a Beijing-based fruit trade company, which set up two subsidiaries to grow kiwis in Shaanxi's Zhouzhi county and Henan's Xixia county.

"There are certain risks in the agricultural businesses," says Liu Chuanzhi, chairman of Legend Holdings and founder of Lenovo. "A good company should be able to make specific plans in analyzing the market and try it best to build up a brand. We have a long-term plan for the future investment in agriculture, but we are not in the hurry to rush it."

Liu says since consumers in China are focused on food safety, companies should realize that a developed industry chain must regulate the production of high-quality foods.

zhongnan@chinadaily.com.cn

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|