Experts call for easing monetary policy

Updated: 2012-06-06 09:10

By Chen Jia (China Daily)

|

|||||||||||

Annual growth in broad money supply, which is know as M2, is likely to decrease to 12 percent in May, lower than the government's target of 14 percent, indicating that lower market liquidity may pull the economy deeper into the doldrums, said Xu.

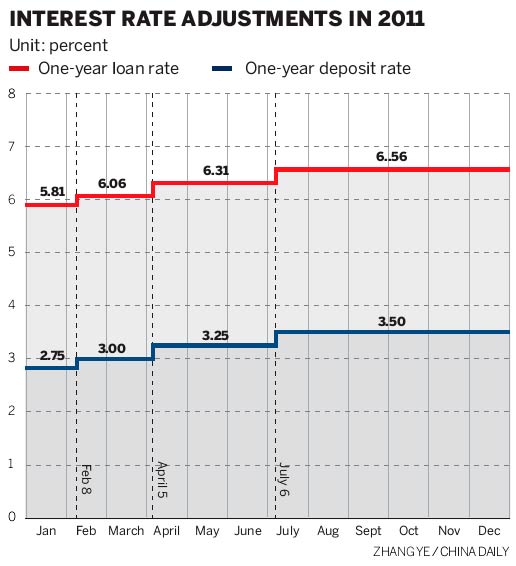

"Now it is the best time to accelerate interest rate liberalization, cutting the loan rate while keeping the deposit rate at the current level, which means that commercial bank interest margin should be narrowed," according to Xu.

Earlier this year, Premier Wen Jiabao vowed to rein in banks' profits and break the major lenders' domination of the market by promoting financial reform.

Xu predicted that last month's consumer price index, a main gauge of inflation, may show a reading of 3.1 percent, declining from the April's 3.3 percent and March's 3.6 percent, because of easing food prices.

"By the end of June, the central bank may cut benchmark interest rates by 0.25 percentage points as well as cut the RRR by 0.5 percentage points," said Liu Ligang, head of China economics at Australia and New Zealand Banking Group Ltd.

He said that another reduction in the RRR by 100 basis points may occur in the second half as inflationary pressures may continue to ease, leaving space for further policy easing.

Besides this, boosting investment in infrastructure projects could be a very effective way to stabilize short-term economic growth, said Ba.

chenjia1@chinadaily.com.cn

Related Stories

China to cut RRR by 0.5 percentage points 2012-05-14 09:09

Chinese stocks fall after RRR cut - May 14 2012-05-14 15:35

Slowing CPI growth may lead to rate cuts 2012-06-01 18:08

PBOC to further interest rates marketization 2012-01-13 09:50

Monetary policy to stay alert on inflation 2012-05-11 17:38

China to timely fine-tune monetary policy 2012-05-11 10:04

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|