Solar power faces eclipse from US tariffs

Updated: 2012-05-28 11:05

By Xie Yu (China Daily)

|

|||||||||||

|

Suntech's headquarters in Wuxi, Jiangsu province. The company exported 460 megawatt modules to the US last year. [Photo/China Daily] |

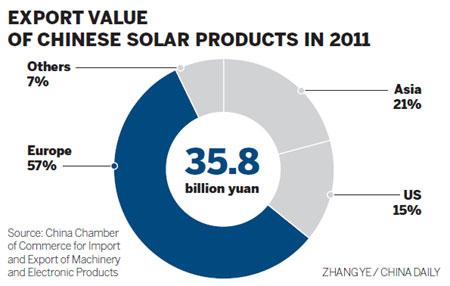

According to statistics from the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, the country imports more than $2 billion worth of polysilicons, ethylene vinyl acetate, sizing agents and other raw materials from the US every year.

If China were to impose duties on these products, US producers would be left shouldering the burden, and China's Ministry of Commerce announced on Thursday that it has uncovered six US policies that support or subsidize the country's renewable-energy industry, in contravention of World Trade Organization rules.

Ren Yifeng, executive secretary-general of the China Society for WTO Studies, said that China's move in uncovering the alleged US subsidies is aimed at hitting back at the anti-dumping duties imposed on Chinese solar products.

"I hope all industry insiders take action to avoid a 'world war' in the solar industry, because fighting each other will not help to promote new energy. What we should do is play according to the market rules, and make solar cheaper and cheaper," said Shawn Qu, the CEO of Canadian Solar.

Challenges for players

Although Chinese companies have only been manufacturing PV products for about 10 years, they now make 60 percent of the products used globally. Technically speaking, China's PV makers are highly experienced and say they are close to achieving a photoelectric conversion rate of 21 percent for each crystal battery, which would be the highest efficiency level to date and would reduce the cost to 1 yuan per kilowatt-hour.

But the sluggish market is exerting pressure on nearly all solar companies. The demand for solar products is falling with European countries, most notably Germany, slashing subsidies for the industry. The US government is imposing new tariffs as it looks to develop its domestic PV industry, while Japan and India are emerging markets with strong demand, but offer limited access to Chinese companies because their governments are highly protective of their own brands.

Meanwhile, a supply glut and falling prices are cutting profits. Experts estimate that for most companies the profit margin has narrowed to just 20 percent from 139 percent previously.

|

|

"A lot of small and medium-sized PV enterprises in China have gone bankrupt or suspended production. Of the remainder, around 20 percent are not even operating at half capacity," said Sun Guangbin, secretary general of the solar PV products branch of the CCCME.

As a result, the nation's leading solar companies are trying hard to lower costs, improve conversion-efficiency rates and explore new markets.

Suntech's Zhang said new markets, including China, Africa, India, and the Middle East accounted for almost 30 percent of the company's total shipments last year. Qu from Canadian Solar said he is committed to strengthening the company's total-solution business, which provides a whole range of services to clients across the entire production process.

Although China is the world's largest producer of solar products, the application of the power generated is not wide enough. Industry players are calling on the government to integrate more solar-generated energy into the country's electricity network. State Grid Corp of China, the country's largest power distributor, has declared its intention of installing 90 gW of wind capacity and 8,000 mW of solar capacity by the end of 2015.

Meanwhile, a recent executive meeting of China's State Council, also stressed the use of off-network solar energy, which could also provide a boost for solar panel installation in factories and homes, according to a report in the Shanghai-based China Business News on Thursday.

"It is true that we are experiencing a difficult time, but I am optimistic about the future, and I believe China will become the largest market for solar in a few years," said Suntech's CEO Shi Zhengrong.

Contact the reporter at xieyu@chinadaily.com.cn

Related Stories

Solar industry may reshuffle upon US punitive duties 2012-05-26 17:17

Punitive duties on Chinese solar cells a 'costly step' 2012-05-26 14:24

Solar firms rally against US antidumping probe 2012-05-25 10:17

Solar insiders upbeat on industry's future 2012-05-19 09:30

US ruling on solar panels 'unreasonable' 2012-05-19 09:16

Chinese solar panel makers eye a nuclear-free Japan 2012-05-09 10:59

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|