Letting the grain take the strain

Updated: 2012-03-05 09:07

By Zhou Siyu (China Daily)

|

|||||||||||

|

A seed bank in Kunming, Yunnan province. China's policymakers have vowed to increase investment in the seed industry to upgrade the country's agricultural sector. [Li Jiuhong / for China Daily] |

|

A farmer loads dried rice stalks onto a cart in Xizhou county, Yunnan province. International investors have got a boost as China's potential and its development of the agricultural sector provides good market opportunities. [Ariana Lindquist / Bloomberg] |

The central government has thrown the focus firmly on food security this year

BEIJING - For those who can sense the way the wind is blowing in China, it is time to sow seeds. During the past nine years, the government has been making a concerted effort to advance the agricultural sector. That's hardly a surprise, given that half of the population lives in rural areas, yet this year's effort is much more down to earth.

|

|

Early every year, China's central government reveals its priority industry by releasing the first major policy proposal, dubbed the "No 1 document". Since 2004, each document has tackled aspects of the agricultural sector. Published on February 1, this year's document focused on the development of agricultural technology.

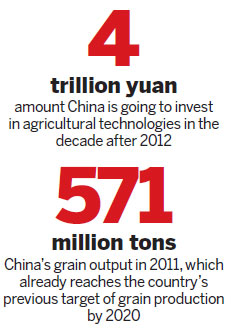

The publication partly reflected the country's unstinting efforts to maintain food security. Chinese farmers have increased the national grain harvest for eight consecutive years since 2003. In 2011, grain output rose to a record 571 million tons, an increase of 4.5 percent year-on-year. Meanwhile, the production volume has already reached the government's 2020 output target for grain, according to the National Bureau of Statistics.

But shrinking natural resources will pose a grave challenge to the production of bumper harvests in the years to come, said agricultural officials and analysts.

In 2012, the sector will be under "great pressure" to achieve yet another increase in grain yields, said Chen Xiaohua, vice-minister of agriculture, in a recent interview.

To boost the development of agricultural production, the government plans to rely on advanced technology. According to this year's No 1 document, the central government will pump more money into the research and development of agricultural technologies. The total amount invested in areas such as seed breeding, livestock and agricultural logistics will stand at more than 4 trillion yuan ($636 billion) in the decade after 2012, according to reports in the domestic media.

China needs to catch up with more advanced economies by developing cutting-edge agricultural technology, said Chen Mengshan, the chief economist at the Ministry of Agriculture. At present, more than 90 percent of the country's high-end varieties of flowers and vegetables are imported, according to the ministry's data. "A considerable number of research projects are following advanced technologies (across the world)," he said.

Seeds of concern

Out of all the agricultural sectors, the seed industry was singled out in the document. "The seed industry will lead the development of the agricultural industry," the document asserted. "More investment will go to fundamental research into the seed industry ... and aid the development of new varieties."

Seeds have long been a headache for many in the Chinese agricultural industry. However, it's not their performance that's the problem; it's their provenance. Industry data show that corn seeds developed by Pioneer Hi-Bred International Inc - a subsidiary of DuPont de Nemours and Co - and its Chinese joint ventures, were sown in more than 2 million hectares of the country's cornfields up to 2011. One of Pioneer's seed varieties has become China's third most popular corn seed in recent years, said analysts.

In terms of vegetable seeds, foreign companies have taken a 15 percent share of the Chinese market, according to data from the Ministry of Agriculture. That figure represents a formidable dominance in the nation's highly segmented seed market, according to analysts.

China has more than 8,000 domestic seed companies. However, most are small outfits with limited ability in terms of research and development. "They are vulnerable in the face of their foreign rivals," said Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultant Ltd, one of the largest consultancies in the industry.

The No 1 document was the latest in a slew of government measures that, since April, have tried to regulate the market and spur development of the industry. The government will "raise the registration threshold for seed companies and encourage mergers and acquisitions between them", while "cracking down on fake and counterfeit seeds in the market", the document said.

One man's medicine

Agricultural stocks and futures were boosted by the message contained in the document. The day after it was issued, nearly all agricultural futures rose on China's major exchanges. Shares in agricultural companies also rose, despite a decline in the market overall.

"The document is good news for the entire industry," said Jin Yi, deputy general manager of Winall Hi-tech Seed Co Ltd, the country's third-largest producer of rice seeds. Based in Hefei, the capital city of eastern China's Anhui province, Jin's company exports rice seeds to a large number of countries, including Bangladesh, Vietnam, Pakistan and Indonesia.

Companies said the document also helped to strengthen their connections with government-funded research institutes. These institutes had previously remained largely isolated from the market. According to the document, the government will encourage research institutes to cooperate with companies and set up a "commercial research mechanism" centered on the needs of the companies.

In the past, small companies with limited resources found it difficult to achieve cooperation with research institutes. That led to many companies simply abandoning research and turning to the production of fake and counterfeit seeds, or whatever turned a profit, said Jin. "Now the institutes will offer themselves up for cooperation with companies," he said.

In the meantime, the companies also expect the document to bring order to the market. Industry data indicates that around 30 percent of China's smaller seed companies are involved in the production and sale of counterfeit seeds every year. In line with measures previously released by the Ministry of Agriculture, the document also stressed the government's determination to fight the production of counterfeit seeds.

"The market conditions are improving," said Lance Wang, general manager of CNSGC-Dekalb Seed Co Ltd, a JV between the US-based crop-biotechnology company Monsanto Co, and Sinochem Co, a Chinese agrichemicals conglomerate.

Wang said the document was the "right prescription" for the country's "ailing seed industry". But he also warned that the current improvement in market conditions might just be low-hanging fruit. What is really needed, said Wang, is a stable and consistent mechanism that will improve the industry and strengthen the protection of intellectual property rights.

Wang's company specializes in corn seeds. In September, it invested 450 million yuan in its first seed-processing factory in Northwest China's Gansu province. When completed, the facility will have an annual processing capacity of 35,000 tons, according to the company.

Wang said he believed that there is still potential in China's huge corn-seed market, given that in recent years the country's corn production per hectare was little more than half of that of the US. "China's market is highly segmented," he said.

However, that may change, too. Analysts believe that, prompted by the document, industry rationalization is just around the corner. China now has more than 120 large seed companies with the ability to undertake research into seed breeding. Only 20 to 30 of them could survive a reshuffle, according to industry reports.

"The market will consolidate into a handful of major domestic players. And they will be big," Wang opined. He also reckoned that China's seed industry might follow the pattern of the US in the years to come. "Big companies conduct research and develop new varieties, while small companies, at the lower level of the industrial chain, build distribution channels," Wang said.

As a result, "Chinese companies will become more competitive", he added.

Another man's poison?

Multinational companies, meanwhile, have found China's maturing seed industry a blessing, not a threat. "The government's No 1 document aims to make China's seed industry more consolidated and more professional," said William Niebur, Pioneer's vice-president and its general manager in China.

Niebur said Pioneer will benefit from the document's emphasis on the development of agricultural technology. With the company's technological advantages, "Pioneer could find new opportunities to cooperate with local companies", he said.

In addition, a more competitive seed industry might convince the government to loosen the regulatory restrictions on foreign seed companies, said Jennie Shen, Pioneer's strategy and business development director for China.

The current regulations mean that foreign companies are limited to a holding of 49 percent in JVs concerning crop seed businesses and, therefore, can never hold a controlling share.

"We are being limited by local regulations," Shen said.

Although its ownership is limited, the US-based company has maintained stable business expansion during recent years. In 2011, its two local JVs claimed a 9 percent share of China's corn-seed market. To many industry observers that presence seemed disturbingly large.

During the same year, Pioneer's Chinese JVs set up three production facilities, two in Gansu province and one in the Xinjiang Uygur autonomous region. "Our plan is to triple the JVs' investment in research and double their production capacities over the next five years," Niebur said.

Pierre Cohadon, regional head in China of Syngenta AG, shared the general opinion of the policy document. The Swiss company is the world leader in crop protection chemicals and the third-largest seed vendor. It was also one of the first multinationals to enter the Chinese market.

In a bid to combine the company's advantages in the seeds and crop-protection sectors, Syngenta rolled out a global program of business integration in Feb 2011. With what it called its "integrated cropping solution", the company said it will provide farmers with services supported by a combination of its crop-protection products and seeds.

The financial gains appear to justify the company's decision to launch the unprecedented business model. In 2011, Syngenta saw sales surge 14 percent on a year-on-year basis to $13.3 billion, while net income also jumped by 14 percent year-on-year to $1.6 billion, according to the company.

The integrated solution has helped the company to lower operating costs, releasing funds that could be plowed into research and development, said Peter Pickering, the regional director for the Asia-Pacific area. According to the company, its investment in research and development "well exceeded" $1 billion in 2011.

Syngenta's integrated solution is still in its infancy in China, said Pickering. "But we are pleased with the tremendous progress (here)," he added.

"We hope to see the market growing more mature and are very optimistic about future expansion in China," said Cohadon.

A more mature agricultural market might also attract more investment and better technologies, analysts said. Agrinos Inc, a Norwegian biofertilizer producer founded in 2009, plans to launch its products in the Chinese market this year. The Scandinavian company has also set up a JV in Beijing to take charge of its Chinese business.

"The future of the farming industry lies in biofertilizers," said company chairman Thorleif Enger. Enger previously served as president and chief executive officer of the Norway-based Yara International ASA, the world's largest producer of conventional fertilizers, so he's familiar with the various segments of the fertilizer market.

The company said its biofertilizers, dubbed "High Yield Technology" products, took 15 years to develop. It claims that the products can increase the efficiency of conventional fertilizers, boost food yields and improve soil quality.

In addition to the huge business potential in China, Enger said he has also been encouraged by the government's willingness to develop the agricultural sector.

"The timing is excellent. We hope to see a major breakthrough in the Chinese market this year," he said.

Related Stories

Drought 'poses threat' to grain security 2011-02-18 07:17

Agricultural efficiency crucial for food security: researcher 2011-01-18 07:44

Drought, food security and markets 2011-06-08 07:56

Urbanization 'threatens food security' 2011-03-28 07:17

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|