Outbound M&A hits record high, says PwC report

Updated: 2012-01-14 09:21

By Hu Yuanyuan (China Daily)

|

|||||||||||

BEIJING - Chinese outbound merger and acquisition (M&A) deals reached a record high of $42.9 billion in 2011, an increase of 12 percent year-on-year, despite the global economic slowdown, according to the accountancy company PricewaterhouseCoopers LLP (PwC) on Friday.

A total of 207 outbound M&A deals were signed last year, up 10 percent from 2010.

"Those figures indicate that Chinese investors' appetite for deals is stronger than ever, across a wide range of industries and geographical locations," said Leon Qian, PwC China's Transaction Services Partner.

The strong growth in outbound deals also pushed the country's overall M&A activity up by 5 percent to 5,364 deals, the highest-ever annual total. Domestic deals climbed 11 percent to 3,262.

"Despite the global macroeconomic climate, confidence among investors looking for M&A deals both within China and abroad remains surprisingly robust," Qian added.

As China moves into a new phase, M&A is emerging as a key enabler of consolidation, growth, market positioning and the acquisition of strategic assets and expertise.

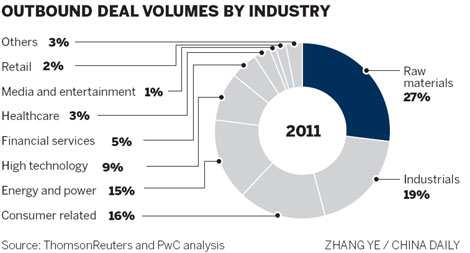

There were 16 outbound M&A deals valued at more than $1 billion by Chinese buyers last year, compared with 12 in 2010. Fourteen of those deals were in the resources and energy sectors.

"Chinese buyers now attach more attention to M&A opportunities in the industrial-products sectors, reflecting the country's gradual shift to a consumer-driven economy," said Edwin Wong, PwC China's International Tax Services Leader

The sluggish global economy, however, is affecting foreign M&A buyers wanting to make a strategic purchase in China, PwC said in the report.

Economic uncertainties in home markets led to an 11 percent decline in foreign M&A activity in China to 482 deals, falling most notably in the second half of last year after a rebound in 2010.

Meanwhile, private equity (PE) is emerging as a key provider of growth capital for China's small and medium-sized enterprises, as they aim to expand despite challenges in raising funds amid fiscal tightening and uncertainty in the equity markets.

The number of larger PE deals (those exceeding $10 million) increased by 18 percent to 437 transactions in 2011 - the highest number ever, according to the PwC report.

Private-equity fundraising also reached a record high in 2011, totaling $44.1 billion for investment in China. Yuan-denominated funds accounted for 60 percent of the total, continuing the trend of the previous two years.

"A key trend is the expansion of the domestic Chinese PE industry; there are now many domestic players who can compare advantageously to their better-known global peers," said Qian.

Related Stories

China defends M&A regulation 2011-09-20 17:24

Chinese outbound M&As hit record levels 2011-08-16 08:04

Vetting of M&A deals to get a speed boost 2011-12-30 08:52

M&A deals rose by 30 percent last year 2011-01-18 07:45

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|