Economy

Finding ways to fight inflation

Updated: 2011-07-19 09:34

By Yang Ning (China Daily)

|

|

|

A vendor at a Beijing vegetable market organizes produce at her stall. Food prices in China increased by more than 14 percent in June over the same month last year. [Photo / China Daily] |

Consumers consider their options as interest rates offered by banks are lower than the CPI

BEIJING - No one needs to tell the average Chinese person that prices are increasing everywhere.

The majority of Chinese consumers are feeling the pinch of surging prices of food, commodities, housing and energy.

In order to battle the effects of inflation on their purses and wallets, some people are changing the way they spend, analysts have said.

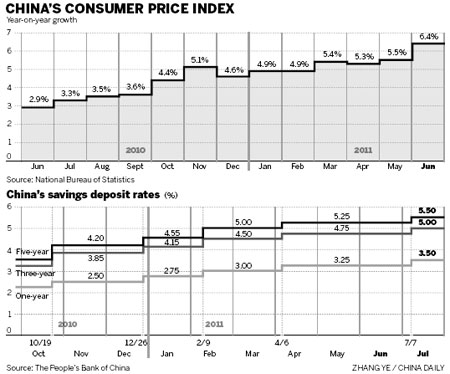

The consumer price index (CPI), the main gauge of inflation, rose 6.4 percent in June from a year earlier, hitting the highest level in three years, according to figures released by the National Bureau of Statistics (NBS) on July 9.

Food prices, which account for nearly one-third of the basket of goods in the CPI calculation, climbed 14.4 percent in June from the same month last year. The price of pork, in particular, soared more than 57 percent year-on-year, the NBS said.

"Surging consumer prices have very little influence on the country's high-income groups. However, they seem to be having a major effect on ordinary families' consumption behavior," said Liang Da, an economist with the NBS.

To begin with, most average Chinese people have made more effort shopping around for the cheapest prices. They also have cut back on their entertainment and recreation spending and deferred some purchases they intended to make previously, said Liang.

Qin Zhengjia, a 27-year-old white-collar worker in Beijing, used to eat out with her friends every weekend at fancy restaurants and go shopping every two weeks but recently she changed her routine.

"I always keep track of my spending every month and I sadly find everything is more expensive than before. I paid nearly 35 percent more on food and clothing compared with last year," said Qin.

"I will definitely reduce the frequency of eating out and shopping because, to be honest, I can't afford the ever-higher costs anymore," she said.

Also, inflation leads to "polarization" among Chinese consumers, encouraging more trading up and down, according to Vincent Lui, Hong Kong-based partner and managing director of Boston Consulting Group.

Consumers will start to question the value of paying a premium for brands "in the middle" - secondary brands rather than global or national leaders in categories from clothes to groceries, he said.

"They tend to consume less or save up for top brands, and they will also look hard at cheaper alternatives - discount brands or private labels of retailers - to fulfill basic needs," said Lui.

In addition, an increasing number of Chinese families have started to focus their attention on a variety of wealth management products for better returns, since the interest rate on deposits does not rise as fast as inflation.

Although earlier this month, the People's Bank of China, the central bank, raised benchmark deposit interest rates by 25 basis points, the current 3.5 percent for a one-year deposit rate still lags far behind the CPI rise.

"China entered an era of negative real interest rates in February last year. Since putting money in the bank is no longer a sensible choice, Chinese families have to search for other approaches as a store of value," said Ye Tan, a Shanghai-based senior financial commentator at a recent forum.

In the first half of this year, Chinese commercial banks sold 8.51 trillion yuan ($1.32 trillion) of wealth management products, exceeding last year's total of 7.05 trillion yuan, according to local media reports.

Ye said the sales of individual wealth management products across the country shot up in recent years. The money collected by them only amounted to 400 billion yuan in 2007.

Xie Qiang, a 35-year-old sales manager at a Beijing-based high-tech company, said currently his main method of building wealth is to purchase wealth management products every month.

"I don't have many investment options with my spare cash because savings rates in banks are lower than inflation, the stock market has been sluggish for months and housing is too expensive for me," he said. "So, short-term and relatively sound wealth management products win out."

Xie recently bought a product from Industrial and Commercial Bank of China, which had a one-month maturity and offered a 5.5 percent annual return.

This month, China Everbright Bank is courting customers with a 12-month product that offers a staggering 8 percent annual return.

However, experts warned that it is important for Chinese families to decentralize and diversify their investments.

Most short-term wealth management products provide an annual return of 4.5 to 5.5 percent at present, according to Wu Yan, a senior wealth adviser at China Everbright Bank.

"Although the return rate is higher than the deposit rate, it is still hard to outperform the CPI. Ordinary investors could also try purchasing funds, gold or other products so as to diversify their investments for better returns," said Wu.

E-paper

The perfect cut

Companies need to revamp, standardize to stave off quality challenges

Crowning achievement

Living happily ever after

Let there be smell

Specials

My China story

Foreign readers are invited to share your China stories.

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

Setting the pace in Turkey

China is building a 158-km high-speed railway in Turkey.