Economy

Forex hike suggests influx of 'hot money'

Updated: 2011-07-13 09:17

By Chen Jiaand Xin Zhiming (China Daily)

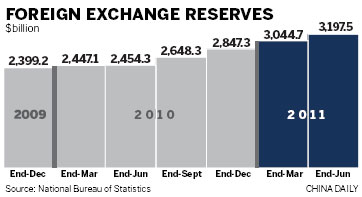

Reserves up 30.3% to $3.2 trillion

BEIJING - China's foreign exchange reserves rose by a faster-than-expected 30.3 percent year-on-year by the end of June to reach $3.2 trillion, a possible indicator of an increasing inflow of "hot money", analysts said.

The reserves are likely to continue to grow in the second half of this year, although at a slower pace, leading to more hikes in the reserve requirement ratio for banks, a tool for policymakers to tame liquidity, they said. The reserve requirement is the amount that banks cannot lend.

|

Foreign reserves rose by $152.8 billion in the second quarter of this year, according to a statement from the People's Bank of China, the central bank, on its website on Tuesday.

The trade surplus, foreign direct investment (FDI) and an influx of speculative capital, or "hot money", have contributed to the surging reserves, analysts said.

China's trade surplus was unexpectedly high at $22.3 billion in June thanks to weakening imports, compared with $13.1 billion for May and $11.4 billion for April. Import growth, which was 19.3 percent in June, was the weakest since November 2009.

FDI rose by $17.8 billion in the April-to-May period, according to the General Administration of Customs.

Those figures suggest that "even taking into account exchange rate valuation and investment returns, net non-FDI capital inflows remained large in the second quarter", said Sun Chi, Nomura Securities economist, referring to "hot money" inflows into China.

Premier Wen Jiabao vowed to "enhance effective monitoring of cross-border capital flows", according to a statement on the central government's website on Tuesday.

Zhuang Jian, senior economist with the Asian Development Bank (ADB), told China Daily that the country's foreign exchange reserves may grow further as the global economy is likely to continue to slow in the coming months, which may reduce worldwide investment opportunities and drive capital flow into China. The country's interest rates are much higher than those in the developed world, such as the US and Europe.

Xu Hongcai, an economist at the China Center for International Economic Exchanges, predicted that by the end of this year China's foreign exchange reserves may grow to about $3.4 trillion.

"The rapid growth of foreign exchange reserves will add more pressure on yuan appreciation and exacerbate the problem of excess liquidity," said Zhuang of ADB.

China currently has invested a large part of its foreign exchange holdings in foreign debt, such as US Treasuries, amid growing concerns over the safety of such investments.

China held about $1.15 trillion of US debt in April, according to US government figures. It also increased holdings of Japanese debt in May.

"China does not have many choices," said Dong Xian'an, chief economist and president of Peking First Advisory Co Ltd.

"Investors may have overreacted toward the European debt crisis and the European and US economy don't have systematic risks," he said.

"The best solution for China is to loosen relevant rules to allow individuals and companies to purchase the reserves and invest abroad. This will diversify the risks, for the State, of holding such a large amount of capital," he suggested.

The central bank also released new yuan lending figures for June on Tuesday. The lending jumped to 633.9 billion yuan ($98 billion), from May's 551.6 billion yuan, despite a number of monetary tightening policies.

The increase was stronger than forecast by Paul Tang, chief economist at the Bank of East Asia in Hong Kong.

"I think the central bank will continue to keep a close watch on credit growth," Tang said. "The government will need to keep up its tightening stance in the second half of the year."

Sun Chi of Nomura Securities wrote in a research note that the "continued accumulation of foreign exchange reserves is likely to cause further bank reserve hikes in the coming months to mop up liquidity".

However, economists are concerned that the continuous tight monetary policy may hurt economic growth.

E-paper

Burning desire

Tradition overrides public safety as fireworks make an explosive comeback

Melody of life

Demystifying Tibet

Bubble worries

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

Say hello to hi panda

An unusual panda is the rising star in Europe's fashion circles

My China story

Foreign readers are invited to share your China stories.