Economy

Tightening may ease: Analysts

Updated: 2011-06-15 09:35

By Wang Xiaotian (China Daily)

|

|

|

According to an economist at the Bank of Communications Co Ltd, further reserve ratio increases will slow significantly in the second half of this year. [Photo/Bloomberg] |

PBOC treading fine line between economic growth and inflation

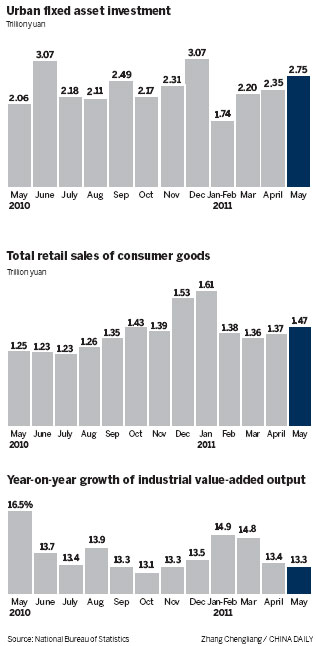

BEIJING - Although China's consumer inflation hit a 34-month high in May, analysts predict that the frequency of further tightening measures will slow in the second half, as commodity prices ease and economic activity declines.

China's consumer price index (CPI), the main gauge of inflation, rose 5.5 percent year-on-year in May, the National Bureau of Statistics (NBS) said on Tuesday. That's the highest level since July 2008.

In the first five months of the year, the index rose by 5.2 percent year-on-year, 1.2 percentage points higher than the 4 percent ceiling set by government.

But the country's economic activity continued to decelerate as industrial output grew 13.3 percent year-on-year in May, down by 0.1 percentage point from the level in April.

He said the frequency of further reserve ratio increases will slow significantly, while the yuan's exchange rate against the dollar will continue to maintain a faster pace of appreciation, probably between 5 and 7 percent through the year.

The slowdown in yuan lending will also help to mop up excessive liquidity, said Lu. China's money growth slowed to a 30-month low in May and banks lent a lower-than-expected 551.6 billion yuan ($85 billion).

Chinese banks will probably provide new loans between 7 trillion yuan and 7.5 trillion yuan through the whole year, said Bank of Communications earlier in a report. Last year new yuan lending totaled 7.95 trillion yuan.

However, the experts hold differing views. Alaistair Chan, an economist at Moody's Analytics, said further monetary tightening is needed to tame persistent core inflationary pressure, as evidenced by the steady rise in non-food prices.

"China's battle with inflation is taking a new shape. Headline inflation is expected to decline in the second half of the year, mostly as food prices pull back and declines in global commodity prices filter through to producer costs. This has given the government scope to raise the prices of retail fuel and industrial electricity," said Chan.

He predicted three more interest-rate increases by the end of the year, when the reserve ratio is forecast to stand at 22 percent from the current level of 21 percent. "A higher reserve ratio also has benefits, such as making the banking sector less risky in an environment of rising bad loans."

To soak up liquidity, the central bank announced on Tuesday that it will raise the reserve requirement, the money that banks have to set aside as reserves, by another 0.5 percentage point effective from June 20. Tuesday's move was the sixth increase since the beginning of the year.

Johanna Chua, chief economist for the Asia Pacific region at Citigroup Inc, said slow or delayed action by the Asian central banks, because of concerns about an economic slowdown, could prove to be very risky as core inflation may continue to rise.

She said for China, greater use of the reserve requirements rather than interest rates will help to keep the cost of borrowing at a low level, and generate a strong incentive to avoid macromonetary regulation. "Therefore there is a risk that the regulation will become less effective."

E-paper

Pearl on the Yangtze

Wuxi is considered a town of natural beauty and its motto is "city of water and warmth".

Prose and consternation

Riding on a mystery train

Way of a warrior

Specials

When two are one

After a separation of 360 years, Huang Gongwang's famous Dwelling in the Fuchun Mountains has been made whole again.

Wealth of difference

Rich coastal areas offer contrasting ways of dealing with country's development

Seal of approval

The dying tradition of seal engraving has now become a UNIVERSITY major