Economy

Inflation hits 34-month high in May

Updated: 2011-06-14 15:32

(Agencies)

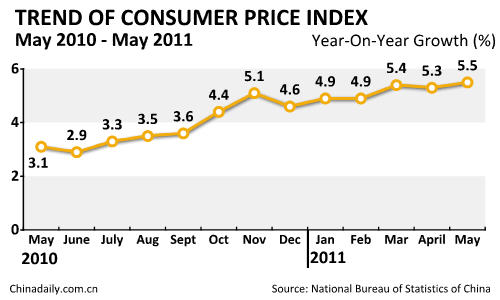

Beijing – China's inflation accelerated in May to a 34-month high of 5.5 percent, supporting the case for a tightening in monetary policy as soon as this month even as there are signs that economic growth is slowing down.

Bringing inflation under control is a top priority for the government, who sees little chance of the current slowdown from 2010 growth of more than 10 percent turning into a hard landing.

Analysts said that a raft of data released on Tuesday suggested the world's second-biggest economy was slowing down, but not too quickly, providing relief for financial markets and leaving room for Beijing to focus on fighting inflation.

"Inflation is quite persistent, while growth is still resilient, so basically we don't see any reason to pause tightening based on today's data," said Wei Yao, an economist at Societe Generale in Hong Kong.

"We think that a June interest rate hike is still on the cards. They could hike anytime."

Producer prices in May rose 6.8 percent from a year earlier, above forecasts of 6.5 percent. That adds to the case for further tightening measures, said George Worthington, an economist at IFR Markets, a unit of Thomson Reuters.

China's central bank has already raised banks' required reserves eight times and lifted interest rates four times since October to quell inflation. The one-year lending rate is 6.31 percent and one-year deposit rate is 3.25 percent.

"Inflation pressures remain large," Sheng Laiyun, a spokesman for the National Bureau of Statistics told a news conference.

Inflation in May compared with expectations for 5.4 percent and showed a pick up from a rate of 5.3 percent in April.

Industrial output in May rose 13.3 percent from a year earlier, the slowest pace since November and broadly in line with expectations for an increase of 13.2 percent.

May retail sales rose 16.9 percent from a year earlier, compared with expectations for an increase of 17.0 percent, while fixed-asset investment between January and May rose 25.8 percent from a year earlier, against expectations for a rise of 25.2 percent.

China's money growth slowed to a 30-month low in May and banks extended fewer new loans than expected, data on Monday showed.

"Overall, China's economic growth is easing gradually, while consumer inflation is still within control. The central bank will raise interest rates again this month, but there will be no further rate rises for the rest of this year," said Xu Gao, an economist at China Everbright Securities in Beijing.

Target in doubt

Inflation has largely been fueled by a rise in food prices, exacerbated of late by a severe drought in farming heartlands. Sheng said pork prices rose in May more than 40 percent from a year earlier.

Some economists say inflation is also the result of China's massive stimulus during the global financial crisis.

Like elsewhere, China also is struggling with a surge in global commodity prices, which are adding to inflationary concerns for policymakers.

The government is aiming for average inflation this year of 4 percent, but doubts are growing that the target can be achieved. Average inflation so far in 2011 is 5.2 percent, the statistical bureau said.

Premier Wen Jiabao said earlier this year that China would use all tools available to control inflation. Policymakers fear that rising food prices, which monetary policy can do little to control, will spread to the wider economy.

Zhang Zhuoyuan, an economist at the Chinese Academy of Social Sciences, a top government think-tank, expects inflation to top 6 percent in June and in remarks reported at the weekend he called for faster steps to push real interest rates into positive territory.

He predicted full-year inflation would be more like 5 percent.

China's economy expanded in 2010 by 10.3 percent, a pace that slowed in the first quarter to 9.7 percent.

But data has suggested a further slowdown in the economy since then. Purchasing managers' surveys showed the factory sector expanded in May at it slowest pace in at least nine months.

Worryingly for financial markets, China's slowdown has occurred alongside a weakening of global growth as Europe struggles with its debt crisis and the United States contends with stubbornly high unemployment. An earthquake has knocked Japan into recession.

Sheng of the National Bureau of Statistics said that even though data has pointed to a slowdown, the economy is on track for "stable and relatively fast growth."

Financial markets had the same reading, offering some relief from concerns that China, as a major engine of global growth, might be heading for a hard landing.

The Australian dollar and oil gained as the data suggested China was still maintaining relatively healthy growth.

Analysts believe that inflation in China will peak around the middle of the year, so policymakers are close to the end of a tightening cycle.

"China's monetary policy setters know it takes time for policy to have an effect," said Xu Biao, an economist at China Merchants Bank in Shenzhen.

"So, we believe that the central bank will not raise interest rates in June. In other words, it will change its practice of raising interest rates every two months. In coming months, the central bank may even relax its monetary policy stance."

E-paper

Pearl on the Yangtze

Wuxi is considered a town of natural beauty and its motto is "city of water and warmth".

Prose and consternation

Riding on a mystery train

Way of a warrior

Specials

Wealth of difference

Rich coastal areas offer contrasting ways of dealing with country's development

Seal of approval

The dying tradition of seal engraving has now become a UNIVERSITY major

Making perfect horse sense

Riding horses to work may be the clean, green answer to frustrated car owners in traffic-trapped cities