Economy

Property prices still rising in most cities

Updated: 2011-05-19 07:18

By Hu Yuanyuan (China Daily)

More tightening measures may be adopted if upward trend continues

BEIJING - More tightening measures may be introduced by the government if property prices and transactions in second and third-tier cities continue to rebound, an industry insider warned on Wednesday.

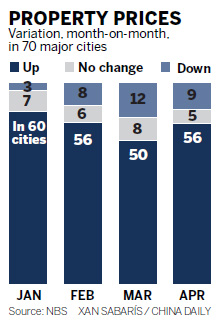

Property prices in April rose year-on-year in 67 of 70 major cities surveyed, according to the National Bureau of Statistics (NBS). Smaller cities recorded higher increases than larger metropolitan areas.

Urumqi, capital of the Xinjiang Uygur autonomous region, posted the biggest increase in property prices of the 70 cities, up 9.3 percent in April from a year earlier. Prices in Mudanjiang, Heilongjiang province, climbed 8.7 percent.

"As far as I know, the government's real estate policies will continue to be rigorous," Mao Daqing, vice-president of China Vanke Co Ltd, the country's largest property developer, said.

As local governments in Beijing, Shanghai and Shenzhen have introduced rigorous restrictions on buying property, investors are turning their attention to second and third-tier cites, pushing up prices.

"Authorities in second and third-tier cities have usually been flexible in implementing State policies and property prices have remained strong," Grant Ji, investment department director at real estate service provider, Savills (Beijing), said.

According to the China Index Academy, 77 cities of the 100 it monitors saw prices rise in April from March. A 0.4 percent rise in prices was recorded, on average, for the 100 cities.

However, price growth in big cities showed signs of slowdown. Prices rose in Beijing by 2.8 percent year-on-year last month, compared with 4.9 percent for March, while prices in Shanghai gained 1.3 percent in April, compared with 1.7 percent for March, the NBS statistics show.

Real estate companies saw a slower growth rate for new bank accounts used for settlements in first-tier cities, suggesting the government's property policies are starting to take effect, the central bank said in a statement on its website on Wednesday.

Since the end of last year the government has launched a slew of measures, including raising mortgage rates for second-home buyers and restricting the number of homes a family could purchase in some cities, to cool the property market.

|

|

"The market will see an influx of apartments in June, July and August. Competition will be intense and we will have a better idea of price trends then."

Some property developers will employ a different strategy than just cutting prices to win customers.

"The market is still not clear at the moment," said a marketing chief at Runze Real Estate Development Co, who declined to be named. "What we can do is adjust our product line to meet the demands of buy-to-live buyers, following the purchasing restrictions in Beijing."

Nicole Wong, regional head of property research at CLSA Asia-Pacific Markets, said price growth will slow this year, and transactions will shrink.

"But demand remains strong due to rising income. And I believe property stocks will perform better than other industries in the second half of the year, as the government's tightening monetary cycle will probably end."

According to a recent report by the China Real Estate Research Institute and the China Real Estate Appraisal Center, the average debt ratio of listed property developers reached 66 percent last year, but their ability to pay the debt is stronger than the previous year due to robust sales in 2010.

The index tracking property stocks on the benchmark Shanghai Composite Index gained 9.7 percent this year, easily outperforming the index's 2.3 percent average increase.

But some experts expressed doubts over the long-term effect of tightening measures.

"The policies may have some effect on property prices, but it's not a fundamental solution," Mao Yushi, a celebrity economist, said. He attributed surging property prices to unbalanced income distribution.

"No matter how high prices are, there are always people who can afford to buy," he said.

Buying property, he added, is the fastest way to make money in China because of limited investment channels.

Wei Tian contributed to this story.

E-paper

Thawing out

After a deep freeze in sales during the recession, China’s air conditioner makers are bouncing back

Cool Iron lady

Of good and evil

Build on security initiatives

Specials

Memory lanes

Shanghai’s historic ALLEYS not just unique architecture but a way of life

Great expectations

Hong Kong-born singer songwriter rises to the top of the UK pops.

A diplomat of character

Belgian envoy draws on personal fascination to help build China ties.