Statistics

China trims holdings of US long-term securities in January

Updated: 2011-03-16 09:35

(Xinhua)

WASHINGTON - Total foreign holdings of US long-term securities in January reached $4.45 trillion, up $15.1 billion, or 0.2 percent from the previous month, but China trimmed its holdings for the third straight month, the US Treasury Department reported Tuesday.

The figures reflect demand for US Treasury obligations and other assets including stocks and government agency debt, a key to funding the massive US balance of payments deficit with the rest of the world.

According to the Treasury International Capital (TIC) report, China, the largest holder of US Treasury securities, reduced its holdings from $1.16 billion in December to $1.15 billion in January.

The figure also shows that China's holdings of the US debt reached the peak of nearly $1.18 trillion in October 2010 and fell to $1.16 trillion in November.

| ||||

Britain, the third largest holder also boosted its holdings to $278.43 billion in January from $272.1 billion in December.

The debt figures are closely watched at a time when more and more Americans believe that the US soaring debt is unsustainable. The federal debt has surpassed 14 trillion at the end of 2010.

US federal budget deficit reached $1.29 trillion in the fiscal year 2010 ended September 30.

It recorded a historic high of $1.42 trillion in fiscal year 2009 when the economy was hit deeply by the financial crisis.

According to President Obama's fiscal year 2012 budget, the US federal deficit in 2011 is expected to hit a new record of $1.65 trillion.

E-paper

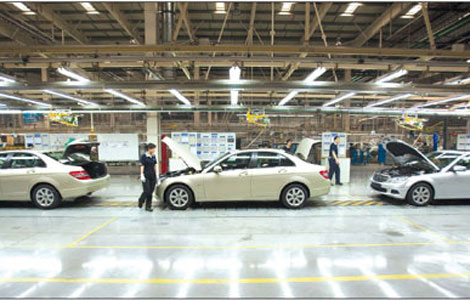

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Dressed for success

Fabric of change

High spirits

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.