Photos

Fuel and power companies lead market decline

Updated: 2011-03-16 10:32

By Zhang Shidong (China Daily)

|

|

|

The Dongfang Electric Corp booth at a high-tech expo in Beijing. On Tuesday, shares of Dongfang Electric dropped 5.24 percent to 30.20 yuan ($4.59). [Photo / China Daily] |

The retreat came after the risk of radiation leaks in Japan escalated and concern grew that last week's quake will slow economic growth in Asia.

Dongfang Electric Corp, which makes nuclear power-related products, fell 5.24 percent. Yanzhou Coal Mining Co led declines among coal producers on concern Japan's demand for the fuel will decline. Ping An Insurance (Group) Co slid 2.77 percent after selling shares to a Hong Kong billionaire to boost capital.

"Investors are worried about the situation in Japan as the blast at the nuclear plant makes it a regional risk," said Zhou Xi, a strategist at Bohai Securities Co. "It's not about the earthquake but more about radiation leakage concerns which will drag down the economy in Japan and even the whole of Asia."

The Shanghai Composite Index dropped 1.41 percent to 2896.26 at the 3 pm close, the lowest since Feb 25. The CSI 300 Index slid 1.81 percent to 3203.96, with all 10 industry groups falling more than 1 percent.

Dongfang Electric plunged 5.24 percent to 30.20 yuan ($4.59). China First Heavy Industries Co, a manufacturer of nuclear power generators, slid 6.32 percent to 6.08 yuan.

PetroChina Co fell 1.28 percent to 11.54 yuan. Yanzhou Coal slumped 5.06 percent to 30.02 yuan. China Shenhua Energy Co lost 2.73 percent to 26.69 yuan.

China Cosco Holdings Co dropped 2.96 percent to 10.16 yuan. China Southern Airlines Co lost 2.49 percent to 8.22 yuan.

Japan's earthquake creates "buying opportunities" for Chinese equities as the temblor may ease pressure on the central bank to tighten monetary policy, according to China International Capital Corp.

"The quake may bring a glimmer of hope that China's central bank may ease the strength of its tightening monetary policies as uncertainty rises significantly overseas," Hao Hong, global equity strategist, said in a report on Monday. "The market may become more volatile and the market corrections will provide buying opportunities."

Bloomberg News

E-paper

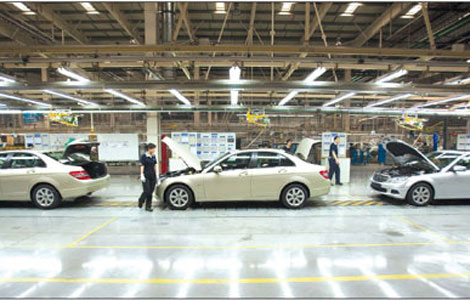

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Dressed for success

Fabric of change

High spirits

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.