Money

Banks race to speed up RMB operations in Singapore

Updated: 2011-03-15 11:13

(Xinhua)

SINGAPORE - The expansion of renminbi operations in Singapore has been speeding up, as banks raced to offer yuan deposit products and access to bonds to meet the growing appetite for the Chinese currency.

ICBC, the world's largest commercial lender, officially inaugurated its first overseas RMB Processing Center in Singapore on Friday, the same day Singapore's second largest bank by assets OCBC launched two offshore RMB deposit products, following similar moves by local rivals DBS and UOB as well as the local branch of global banking giant HSBC.

"Singapore investors and our customers have shown very strong interest in renminbi-denominated deposits and investments and we expect this to continue as the RMB gains prominence," a spokesperson for HSBC said.

RMB Processing Center

Wang Lili, executive director and senior vice president of ICBC Group, said the banking giant will leverage on the favorable geographical location and business environment as an international financial and trade center to make the Singapore branch "ICBC Group's RMB Processing Center for Southeast Asia."

While the establishment of an RMB Processing Center will bring no major difference to ICBC's RMB operations in Singapore, it is a branding effort by the bank to push ahead its offshore RMB operations.

It is a decision thoroughly thought over to establish such a center in Singapore, and it shows the bank's confidence in the prospects of the RMB businesses in Singapore, said Wang Lili.

She highlighted ICBC's status as the world's largest bank in terms of RMB transactions, saying that the banking giant is now striving to extend domestic RMB capabilities to beyond the Chinese markets.

"The establishment of RMB Processing Center marks yet another major breakthrough in the steady implementation of the bank's internationalization strategy," she said.

The Singapore branch of ICBC is one of the first to start cross- border RMB settlement in 2009. It is now No 1 by the number of transactions and No 2 by volume among the overseas branches of ICBC group.

Surge in RMB businesses

In a sign of acceleration of the growth of RMB businesses over the recent months, the Singapore branch of ICBC said its RMB deposit balance grew by an astounding ten times from the end of 2010 to hit nearly 2 billion yuan ($304 million) by the end of February this year.

Meanwhile, other Chinese banks, like the Bank of China, are also developing their RMB businesses in Singapore.

The card business is also growing quickly. The volume of transactions made through China Unionpay cards issued in cooperation with the banks in Southeast Asia surged 89 percent year on year as at the end of 2010, Yang Wenhui, chief representative of China Unionpay, said in a recent interview with Xinhua.

China Unionpay now has card business operations in 12 countries in the region. By the end of 2010, 99 percent of the ATMs in Singapore accept Unionpay cards, as do 70 percent of the shops.

China Unionpay also plans to launch new RMB card products within the year, including possibly debit cards and cash cards, Yang said.

RMB retail products

Other banks in the local market have also been racing to launch RMB retail products recently. HSBC Singapore launched its suite of RMB savings and time deposit accounts in January to the needs of wealthy customers, followed by Singapore's largest bank DBS Bank in February and the second and third largest banks OCBC and UOB in March.

HSBC Singapore said it has raised 1.4 billion yuan by March 10.

"We anticipated pent-up demand for the RMB from customers but still, the response has exceeded our expectations," said Greg Zeeman, head of personal financial services at HSBC Singapore.

"We see good growth potential in the outlook for RMB- denominated investments, given that demand and access to the currency is rising rapidly," he said.

The bank said the development of RMB trade settlement in the region is also accelerating at a faster than expected pace and more clients in Singapore "are in active discussions with us on financing their trade in RMB."

On a wider front, RMB as percentage of Hong Kong's total deposit base has grown from below 1 percent to more than 5 percent in the second half of 2010, and the number of new RMB bond issues in 2010 exceeded the total number of bond issuances in the preceding three years, the bank said.

RMB-denominated bonds

In yet another sign of the deepening of the RMB market in Singapore, the banks are also offering or planning to offer access to RMB-denominated bonds.

The growth of both money supply and the bond market is essential to the deepening of the market for any given currency.

"Another important driver for the development of the offshore yuan market is the deepening of the offshore yuan bond market," said Daniel Hui, senior foreign exchange strategist at HSBC Global Research.

"We would expect the bond market to grow at the pace of offshore yuan supply growth. We also foresee demand for offshore yuan bond issuance from both onshore companies and multinationals, "he added.

Both UOB and OCBC said they planned to offer offshore RMB- denominated bonds by the end of March for retail investors in Singapore. UOB said its fund aims to generate fixed income returns and benefit from the potential appreciation of yuan over the medium term by investing primarily in offshore RMB debt securities and bonds.

DBS also said last month it planned to launch access to the Hong Kong yuan-denominated bonds from Singapore in the weeks ahead.

E-paper

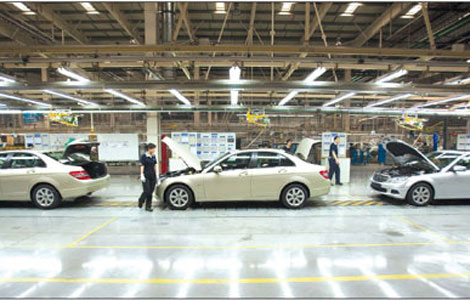

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Preview of the coming issue

Dressed for success

Fabric of change

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.