European lenders mull next China moves

Updated: 2010-12-17 12:36

By Zhou Yan (China Daily European Weekly)

|

|

With most of the other domestic lenders ringing in healthy numbers during the same period, it is evident that the domestic lenders are on a strong perch, despite the recent regulations aimed at curbing lending to prevent asset bubbles from forming.

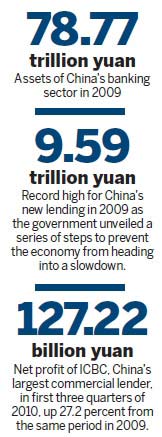

China's new lending reached a record high of 9.59 trillion yuan in 2009 as the government unveiled a series of steps to prevent the economy from heading into a slowdown.

"Financing of domestic enterprises, notably construction and property and some infrastructure, remains with domestic banks and will not change in the near future," says Alistair Milne, reader in banking at the Cass Business School.

The late opening up of the Chinese financial markets and restrictions on the number of outlets that foreign lenders could have also acted as speed breakers for European lenders.

"The fierce competition is natural for such a fast-growing market. Chinese banks obviously have a huge advantage due to their size and number of outlets," says Fredrik Hahnel, general manager of Nordic bank SEB's Shanghai branch.

"I believe that the figure will go up, but certainly not as fast as foreign banks would want."

Li at RBS says Chinese banks have a strong competitive edge in terms of the huge customer base they enjoy against which they can leverage their product offerings. "This will increase their market share and leave only a small share for foreign banks".

"As China has opened up its banking system, the CBRC has sought to follow and adopt the best practices of banking supervision from developed countries. In the current global climate, banks are likely to see a trend toward more constraints rather than deregulation. The implications will be felt strongly by foreign banks," KPMG says in its report.

Despite such obstacles, foreign banks are still bullish on the Chinese market as the pace of recovery in their home markets remains uncertain. The recent debt crisis in Ireland has affected several European banks such as RBS, HSBC, BNP Paribas and Societe Generale.

Paper's Digest

Convertible yuan

The yuan is likely to be fully convertible and on the way to being one of the world's major currencies by 2020.

Fight against inflation

Words of passion

Euro vision

Specials

Internet aids luxury sales

More sophisticated Chinese consumers are surfing for luxury products on the Internet and a number of branded labels are ready to ride the wave.

Tobacco controls

An anti-smoking watchdog has criticized Chinese authorities for "making little progress" on enforcing tobacco controls.

Godfather of yachts

Traugott Kaminski claims he was the first person to bring the yacht culture to China seven years ago.