Asia's budding bankers no longer feel need to go West

Updated: 2010-07-26 09

(Agencies)

Unlike many young, finance-focused Asian graduates before him, Boon Seong Lim is happy to stay close to home to launch his career.

Lim, aiming for a mergers and acquisitions department, represents a new wave of Asian recruits who don't feel the pull of having to start on Wall Street or in London's City, partly mirroring a broader shift in the global banking sector where talent and transactions are migrating from West to East.

"People used to think it was better to start your career in London or New York," said the 21-year-old Malaysian, speaking between sessions at a packed Asian investment banking conference hosted in Singapore this month by the London School of Economics.

Now, launching a finance career in Singapore, Hong Kong or elsewhere in Asia can get you just as far in the business.

For the banks, the move to hire, develop and promote homegrown talent in Asia is a key part of their expansion in a market that is becoming a major contributor to their bottomline.

"There is a recognition of the fact that the world is shifting in terms of economic growth and importance, and the regions here are going to be very relevant in terms of the level of activity," said Farhan Faruqui, head of global banking Asia Pacific at Citigroup .

While those born in the United States and Europe still occupy top spots at investment banks in Asia, a new crop of Asian professionals has occupied corporate suites in recent years, with a trickle down to trading floors and sector teams.

"I'm a dying breed," said Ronnie Behar, Credit Suisse's head of Southeast Asia M&A, speaking at the LSE conference. Behar, a Westerner based in Singapore, was referring to the number of Asia-bred bankers joining Credit Suisse, which has ramped up hiring in the region.

"I don't think there's the need now, if you're starting your career, to go work in the U.S. or Europe," Behar said, adding Asia's M&A sector has gone from a small, financing-focused product just five years ago to a significant part of a bank's business in the region.

MEGA DEALS

The clout and experience of earning stripes in New York or London still holds serious weight in banking as these financial centres are home to most of the world's top banks and handle much of the largest transactions.

But Asia has seen two of the world's largest deals this year: Prudential Plc's failed $35.5 billion takeover of AIA and the $19.3 billion IPO of the Agricultural Bank of China.

Paper's Digest

China bags Asiad team tennis title after 24 yrs

Wimbledon semifinalist Li Na led host China to capture the team tennis title on Tuesday at the Asian Games, accomplishing her Asiad tour with three consecutive victories.

China rate rises no panacea to curb inflation: PBOC adviser

Specials

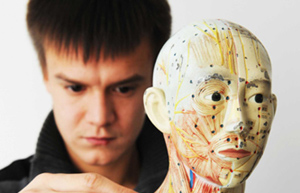

Russian possessed with TCM

Born into a family of doctors, Maxime became interested in Traditional Chinese Medicine (TCM) at the age of 12, after hearing about TCM theories such as health preservation and recuperation.

Acupuncture takes stab at UNESCO list

Acupuncture and Peking Opera have been selected as candidates for UNESCO intangible cultural heritage status.

The wedding coach comes back to life

A groom carries his bride from a wedding coach in Xuchang, Henan province, Nov 11, 2010. Produced a local factory, various original hand-made wedding carriages were displayed on the streets, attracting young people chasing fashion and an environment-friendly lifestyle.