Asia bonds beating bunds leads Pictet to triple funds

Updated: 2010-07-21 14

(Agencies)

'Asia is safer'

"People aren't getting much from stocks, and at least they're getting an income stream from bonds," said De Mello, who helps oversee $482 billion at Western, the Pasadena, California-based fixed-income unit of Legg Mason Inc. "People are looking at debt-to-GDP figures, and they're seeing that Asia is safer."

US publicly traded debt has risen to a record $8.1 trillion, 57 percent of gross domestic product. The similar figure for Japan is 197 percent, or $9.7 trillion. By contrast, India's is $417 billion, 36 percent of its GDP, and Indonesia's is $89 billion, or 17 percent, according to data compiled by Bloomberg.

Moody's raised South Korea's rating by one level to A1 in April, citing a "relatively small" deficit. It boosted its outlook on Indonesia's Ba2 grade last month, forecasting "sustained strong growth." The US's top ranking will come under pressure unless additional measures are taken to reduce projected record budget deficits, Moody's said in May.

Foreign reserves

Asia's developing nations and regions have accumulated $5 trillion of foreign-exchange reserves. The Chinese mainland has $2.45 trillion, the world's biggest holdings, while Taiwan, South Korea, India, Hong Kong and Singapore also rank among the top 10.

"Asian currencies look very stable in comparison with other emerging-market currencies because of their record reserves," said Masataka Horii, a money manager in Tokyo for Kokusai, which runs Asia's largest debt fund as part of its $56.2 billion in assets and is bullish on India and Indonesia.

Regional bonds remain risky because prices for goods and services may rise as economies improve, eroding the value of their fixed payments, said Sergey Dergachev, who helps manage about $6 billion of emerging-market debt at Union Investment in Frankfurt, Germany's third-largest money manager.

Inflation risk

"Due to increasing inflationary pressures, there is risk of a tightening monetary policy environment," Dergachev said. "Rising interest rates will hurt direct bond performance."

In China, consumer prices climbed 2.9 percent in June from a year earlier and 3.1 percent in May, the biggest increases since October 2008, official figures show. India's wholesale price index has recorded increases of more than 10 percent in each of the last five months and the central bank raised interest rates for the third time this year on July 2.

The Bank of Thailand raised borrowing costs on July 14 for the first time since 2008, joining central banks in South Korea, India, Malaysia and Taiwan in having increased rates in the past month. Singapore, which reported record economic growth of 18.1 percent for the first half, is targeting a "gradual appreciation" of its currency to combat inflation.

De Mello, whose most recent purchases include bonds in Malaysia, predicts economic expansion will fuel currency gains and support the region’s yield advantage. Asia's developing economies will expand 9.2 percent this year, outpacing growth of 3.3 percent in the US and 1 percent in the euro area, based on IMF projections published on July 7.

Currencies, yields

Malaysia's ringgit, Indonesia's rupiah and China's yuan are among the 10 best-performing emerging-market currencies this year. Ten-year government bonds yield 3.91 percent in Malaysia, 4.92 percent in South Korea and 8.19 percent in Indonesia, compared with 2.95 percent on US debt.

|

||||

The Templeton Global Bond Fund returned 11 percent on average over the past five years, beating 97 percent of its competitors, according to data compiled by Bloomberg. Hasenstab is betting on bonds in South Korea, Malaysia and Indonesia, according to holdings the company published as of May 31.

Pictet's fund has returned 11 percent over the past year, while Western Asset's gained 13 percent. Kokusai, betting on India and Indonesia, is up 8 percent.

Mitsubishi UFJ Asset Management Co, a unit of Japan's biggest publicly traded bank, bought Singapore dollars in April and plans to purchase Indonesian rupiah, said Hideo Shimomura, the chief investor.

"We are confident that Asian currencies are quite safe," said Shimomura, who helps oversee the equivalent of $56.2 billion in Tokyo. "They are good for hedging against the US dollar and the euro."

Paper's Digest

China bags Asiad team tennis title after 24 yrs

Wimbledon semifinalist Li Na led host China to capture the team tennis title on Tuesday at the Asian Games, accomplishing her Asiad tour with three consecutive victories.

China rate rises no panacea to curb inflation: PBOC adviser

Specials

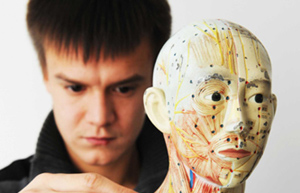

Russian possessed with TCM

Born into a family of doctors, Maxime became interested in Traditional Chinese Medicine (TCM) at the age of 12, after hearing about TCM theories such as health preservation and recuperation.

Acupuncture takes stab at UNESCO list

Acupuncture and Peking Opera have been selected as candidates for UNESCO intangible cultural heritage status.

The wedding coach comes back to life

A groom carries his bride from a wedding coach in Xuchang, Henan province, Nov 11, 2010. Produced a local factory, various original hand-made wedding carriages were displayed on the streets, attracting young people chasing fashion and an environment-friendly lifestyle.