Better finance for emerging segments

Financial institutions in China are expected to step up efforts for enriching quality financial services for the manufacturing sector, especially strategic emerging segments, to facilitate industrial upgrade and the advancement of new industrialization, experts said on Wednesday.

Their comments came after the country unveiled on Tuesday a circular calling for stronger and better financial support for the manufacturing sector, with 17 items detailing requirements for enhancing supply of financial services, improving the services systems and strengthening risk prevention among others.

Jointly published by the National Financial Regulatory Administration, the Ministry of Industry and Information Technology and the National Development and Reform Commission, the circular said the country will focus on key tasks to strengthen financial support for the manufacturing sector.

Those key tasks include supporting industrial and supply chain safety and stability, promoting sci-tech innovations for industrial development, facilitating industrial upgrade and optimization of industrial structure, and promoting the intelligent and green development of industries.

Zhou Maohua, a researcher at China Everbright Bank, said that China has been continuously deepening the supply-side structural reforms in the financial sector.

"Financial institutions have been encouraged to provide solid support to the manufacturing sector and key emerging segments such as scientific and technological innovation, and green economy," Zhou said.

"The implementation of the circular will further motivate financial institutions to strengthen their willingness and enhance their services to allocate more resources to the high-end manufacturing sector, thereby significantly adding to the industrial chain resilience in the manufacturing sector and supporting sci-tech innovations, to eventually accelerate new industrialization and development of new quality productive forces."

The circular asked banks to allocate more credit resources to support the development of the manufacturing sector, and continuously increase the proportion of medium- and long-term loans in overall loans extended to the sector. They should also strengthen the utilization of credit information in the sector, increase credit and reduce reliance on collateral, it said.

In addition, it asked banks and insurers to strengthen medium- and long-term financial support for the upgrade of equipment and technologies in traditional manufacturing sectors, as well as enhance the role of the national industry-financing cooperation platforms, to promote the efficient matching of financial resources with the financing needs related to industrial upgrade.

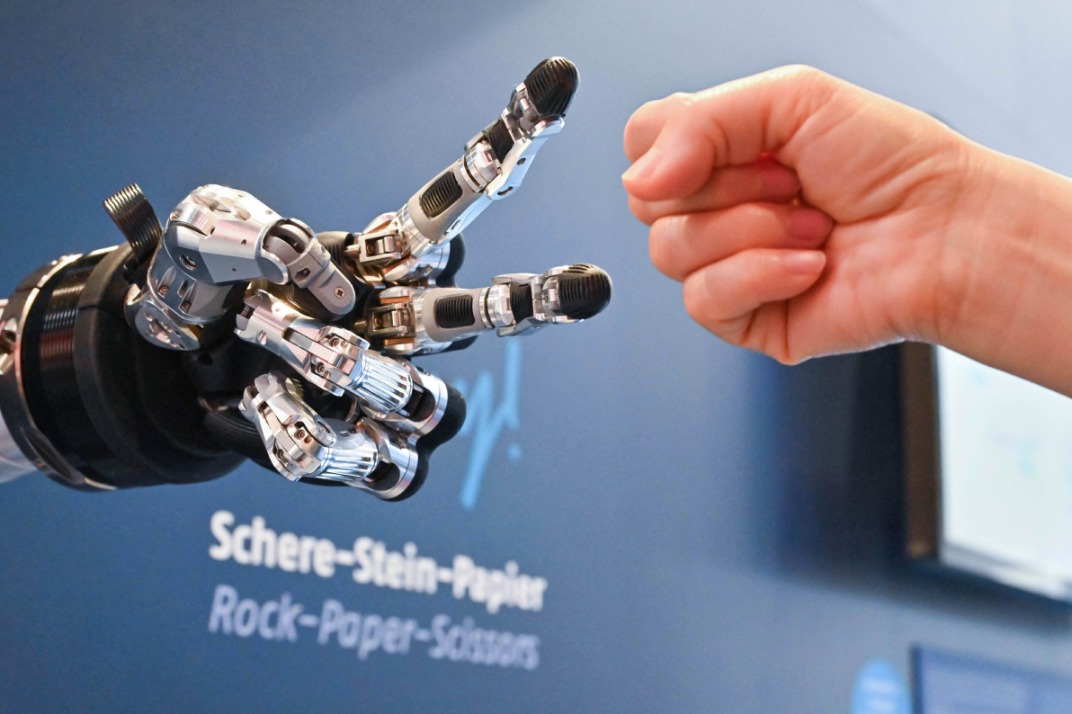

It also urged financial institutions to facilitate the cultivation and expansion of strategic emerging industries. With a focus on key industries like information technology, artificial intelligence, the internet of things, biotechnology, new materials, high-end equipment and aerospace, the circular asked them to strengthen financial support and risk prevention, and expand the scale of credit extended to strategic emerging industries.

Insurance funds should work on the premise of keeping risks controllable and, from a commercial perspective, be willing to provide long-term stable financial support to strategic emerging industries. Such support could be in the form of bond purchases, direct equity investment, private equity funds, venture capital funds and insurance asset management products, it said.

Zhou said he expects financial institutions to further improve their customer service efficiency by optimizing the processes of services access, approval and post-loan management.

In performance appraisals, financial institutions should give more consideration to businesses in the manufacturing sector and innovation-oriented sci-tech enterprises, said Zhou.

Li Peijia, a senior analyst at Bank of China, said the country should help financial institutions further enhance their ability to evaluate risks and value of innovation-oriented sci-tech enterprises by promoting information-sharing within the sector.