Globalization has reached a turning point

Ten years since the global financial crisis, the world economy seems to be moving toward stabilization, but the risks, rather than declining, have increased significantly

Thanks to the active economic measures it took in response to the global financial crisis, China has achieved considerable results in the decade since the collapse of Lehman Brothers. In 2008, China and the United States accounted for 7.2 percent and 23.1 percent of the world's GDP, respectively. By 2017, China's share in the world economy had jumped 7.8 percentage points to 15 percent while that of the US increased 1.2 percentage points to 24.3 percent.

The world economy seems to have emerged from the crisis to move toward a period of stability. According to the International Monetary Fund, the global economic growth rate in 2017 was likely to be 3.7 percent, close to the 3.74 percent long-term equilibrium global growth rate from 1990 to 2007. More important, the world economy is expected to grow by 3.9 percent this year and in the subsequent years.

A key fact that cannot be ignored is that in the past 10 years, China has contributed substantially to the world economic recovery. For example, even though its GDP accounted for only 8.5 percent of the world total in 2009, it contributed as much as 50 percent to global economic growth. On average, the Chinese economy has contributed to more than 30 percent of global growth in the past decade.

The price of boosting global growth high

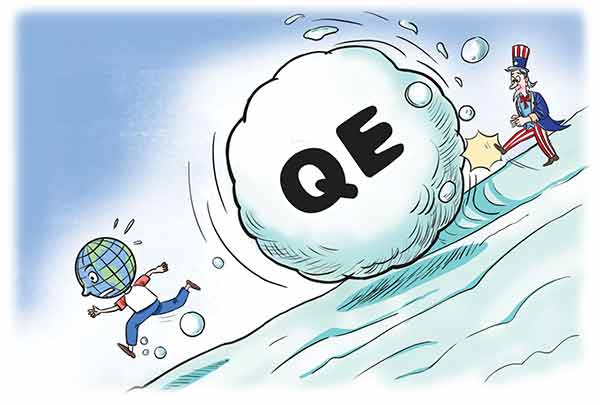

But in pushing up global economic growth, China's economy has paid a high price. Over the past decade, China's debt-to-GDP ratio has soared by 114 percent, from 143.1 percent in 2008 to 255.7 percent in 2017. China's passive leverage increase is intrinsically related to the economic bailout measures, such as quantitative easing, adopted by developed economies from 2009 to 2015. For example, the benchmark interest rate of the US Federal Reserve remained at or close to zero until 2015.

However, due to pessimistic expectations, the liquidity resulting from the quantitative easing policy in the developed economies has not boosted their domestic consumption or investment. Instead, it has entered China on a large scale, appreciating the currency and raising the prices of real estate and other assets.

Second, the spillover effect of the developed economies' monetary policy triggered another crisis. Since 1990, the world economy has experienced two economic bubbles. One was the information technology bubble of the late 1990s, which burst in 2001. The other was the financial and real estate bubble of 2008. As a result, the global financial crisis hit the developed economies with high leverage the most, while low-leverage emerging economies generally managed to maintain economic growth.

To overcome the crisis, the developed economies adopted a policy mix of austere budgets and quantitative easing, and promoted structural reforms to revive manufacturing. And to control the asset bubble created by the inflow of global liquidity, the emerging economies have had to tighten monetary policy and ease fiscal policy. But the inability to properly manage the huge inflow of liquidity has led to the bubble-driven property sector boom in many of the emerging economies.

Crisis changed big powers' strategies

The global financial crisis literally changed the strategy of the big powers. For instance, for its economic recovery, the US mainly depended on the quantitative easing and expanded macroeconomic policies for exports in the short term; on trade protectionism, and re-industrialization, re-innovation and re-export and other anti-globalization policies in the medium term; and on the shift in global economic and trading rules in the long run.

Instead of taking responsibility for creating the bubble, the US has blamed China for the global economic imbalance. It has also demanded the appreciation of the yuan and required China to drastically increase imports and consumption while forcing it to also shoulder the responsibility of adjusting overcapacity.

But now that developed economies such as the US seem to be recovering, it is likely that the bubbles in the emerging economies will burst. After the US economy entered a period of recovery in 2015, it abandoned the quantitative easing policy and started raising the interest rate, with the resultant appreciation of the US dollar leading to a large inflow of global capital into the US.

This broke the global recovery balance, triggering a new round of global economic shock. Due to the normalization of US monetary policy and the revitalization of manufacturing and trade protectionism, the current uncertainties in the global economy have increased, creating immense trouble for some emerging economies and their currencies.

And third, the new crisis is deepening because of the rise of trade protectionism in some economies. After the slowest economic recovery in history, the growth of world trade, investment and manufacturing sectors is getting stronger. Still, the IMF has cautioned that if the medium-and long-term structural contradictions are not resolved, the next recession could occur earlier than expected and will be harder to deal with. The world economy seems to have reached a crossroad, where joint efforts will improve economic recovery and growth, and unilateral actions will cause long-term chaos.

Three questions on globalization

At this juncture, the US has instigated a tariff war in order to establish a new global economic order based on US-dictated principles. Which raises three important questions:

First, globalization based on Western rules since 1918 has reached a turning point. Relying on globalization driven by open markets and innovation cannot sustain further development, not least because of the Donald Trump administration's attempt to use globalization to "make America great again". So what will a fair global trade governance structure be like?

Second, despite being the leading driver of globalization since 1918, the US is no longer willing to promote inclusive global growth, by taking more responsibilities for providing public goods and facilitating internationalism. So what should be the obligations of a responsible big power?

Third, since 1918, emerging markets and developing countries have been slowly moving closer to global center stage. But the existing globalization governance structure does not truly reflect their interests and will, as globalization has not developed to become more open, balanced, coordinated and cooperative. And since the US is using unilateral methods such as a trade war to forcibly extract "its pound of flesh", what actions should China take to meet the requirements of being a responsible big power?

Ten years after the global financial crisis, the world economy may have begun to stabilize, but the risks, rather than decreasing, have risen significantly. The 2018 Global Risk Report released at the Davos Forum in January indicated the world has entered a critical period of increased risks. About 90 percent of the respondents to the survey said they believed the political and economic confrontations between the big powers are likely to intensify this year. And, in the next 10 years, the world could find it more difficult to enjoy the hard-won economic stability.

The author is chief economist at the China Center for International Economic Exchanges. He contributed this article to China Watch, a think tank powered by China Daily.