Social insurance premium not an extra burden

China has launched several policies in recent years to cut taxes and administrative fees, which have helped ease the burden of enterprises. The reduction of taxes and administrative fees could reduce the enterprises' cost by 1.1 trillion yuan ($160.39 billion) this year, which will enhance the vitality of enterprises and stabilize economic development.

But a joint meeting of five departments, including the State Administration of Taxation on Aug 20 that issued the reform plan for tax collection and advanced the uniform levying of social insurance premiums from Jan 1, 2019, has triggered a public debate on whether the move will increase the financial burden of the enterprises.

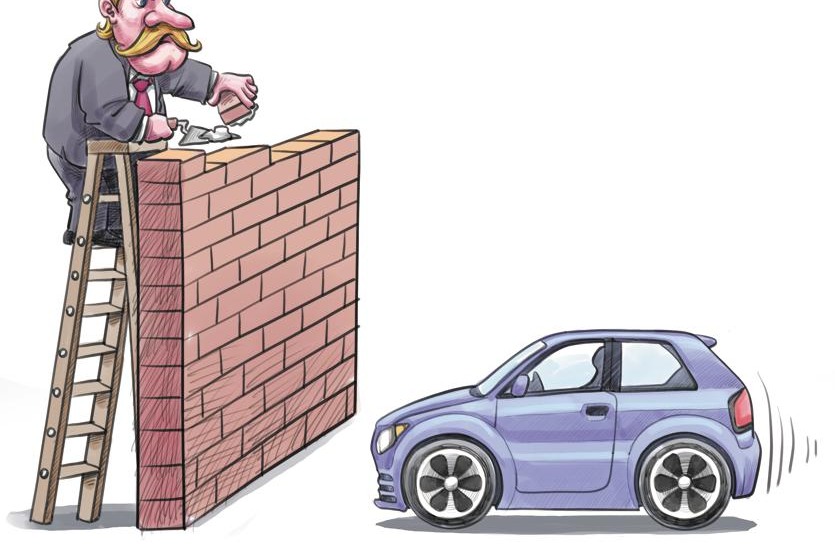

Some people assume that the uniform levying of social insurance premium on the enterprises will increase their burden and thus create obstacles to their sustainable development. The issue does deserve attention, but it should not be used to impede the pace of tax collection and management system reform.

First, the uniform levying of social insurance premium will only change the collection method, and the taxation authorities' aim is not to increase the enterprises' burden. The enterprises' profit will decline not due to the tax authorities' move but because they have not contributed their share of the social insurance premiums to their employees' social insurance funds in the past years. And any support to these enterprises would justify their illegal practice of "stealing" public funds, and undermine fair market competition.

That a majority of the enterprises' have contributed their share of social insurance premiums according to the law means they are facing unfair competition because of the defaulters. So ensuring that all the enterprises pay their rightful contribution to social insurance funds will be conducive to ending this unfair competition.

Second, the negative influence of uniform levying of social insurance premium on economic growth and employment will not be as huge as some people claim. If the new policy forces a few enterprises to shut shop because of the ensuing business difficulties, it will be good for the healthy development of the market. Also, the closing down of such enterprises will reduce low-efficient production capacity, which will help ease the pressure of overcapacity and improve the profitability of the rest of the enterprises in that sector.

Even if the closing down of such enterprises results in a supply gap and job losses, they will be filled in with the induction of new quality capital in the market.

And the resultant improvement in the business environment could promote innovation and startups, as well as the healthy development of new industries and new types of businesses, which will help reduce the negative impact of these enterprises' collapse.

In addition, with the continuous release of reform dividend, the influence of uniform collection and strict management of social insurance premiums will lead to reduced costs. So economic growth and employment will not be affected in the long run.

Moreover, the tax authorities could also implement some flexible policies according to the actual situation of the enterprises to help them smoothly overcome difficulties for a certain period of time.

The tax authorities' efforts to reduce taxes and administrative fees have been widely recognized, but the comprehensive tax burden of Chinese enterprises is still relatively heavy. In particular, after the Western countries recently launched some policies to cut taxes, the gap of the tax burden between the enterprises at home and abroad has expanded. Plus, there is some room for cutting or exempting some administrative fees including governmental funds.

As for the social insurance premium, since the central government does not intend to increase the enterprises' overall burden, there is reason to believe the authorities could reduce the comprehensive rate in the future after the enterprises pay all the social insurance premium arrears.

But it should also be clarified that the intention of reducing taxes and administrative fees is to reduce the gap between the tax burdens of enterprises in China and other countries to help the Chinese enterprises better participate in international competition.

The author is a researcher at Chinese Enterprise Confederation.