PwC forecasts fewer, higher-quality A-share floats

Chinese A-share IPOs decreased in the first half of the year both in number and value terms, with estimates putting the year's total financing at 200 billion yuan ($30 billion), according to a PwC report released on Tuesday.

The number of IPOs on the Shanghai and Shenzhen stock exchanges totaled 63 in the first half of the year, 74 percent lower than the same period last year, said the report from PwC, also known as PricewaterhouseCoopers.

In value terms, 93.1 billion yuan was garnered in the first half of 2018, 26 percent lower than in the first half of last year.

The companies that listed predominantly operate in industrial products, consumer goods and services, and the IT and telecommunication sectors, the report said.

Frank Lyn, PwC markets leader for the Chinese mainland and Hong Kong, said the regulator implemented more stringent criteria for IPO approvals at the outset of 2018, which has helped to prioritize higher-quality listings while inhibiting companies with financial issues.

As a result, many companies have voluntarily withdrawn their applications, and one consequence has been a reduction in the waiting time for approvals, he said.

"Looking ahead to the second half of 2018, we predict A-share IPOs will be affected by a range of factors, in addition to the strict approval process," Lyn said. "The number of IPOs is expected to maintain the trend of the first half, leading to an estimated total number of 100 to 120 IPOs for the whole year, raising around 200 billion yuan."

Jean Sun, assurance partner at PwC China, said after the IPO expansion in 2016 and tightening toward the end of 2017, the China Securities Regulatory Commission has been pursuing greater balance in the IPO arena.

"The regulator has also implemented a number of initiatives in restructuring listing and delisting, which will further improve the quality of China's capital market," Sun said.

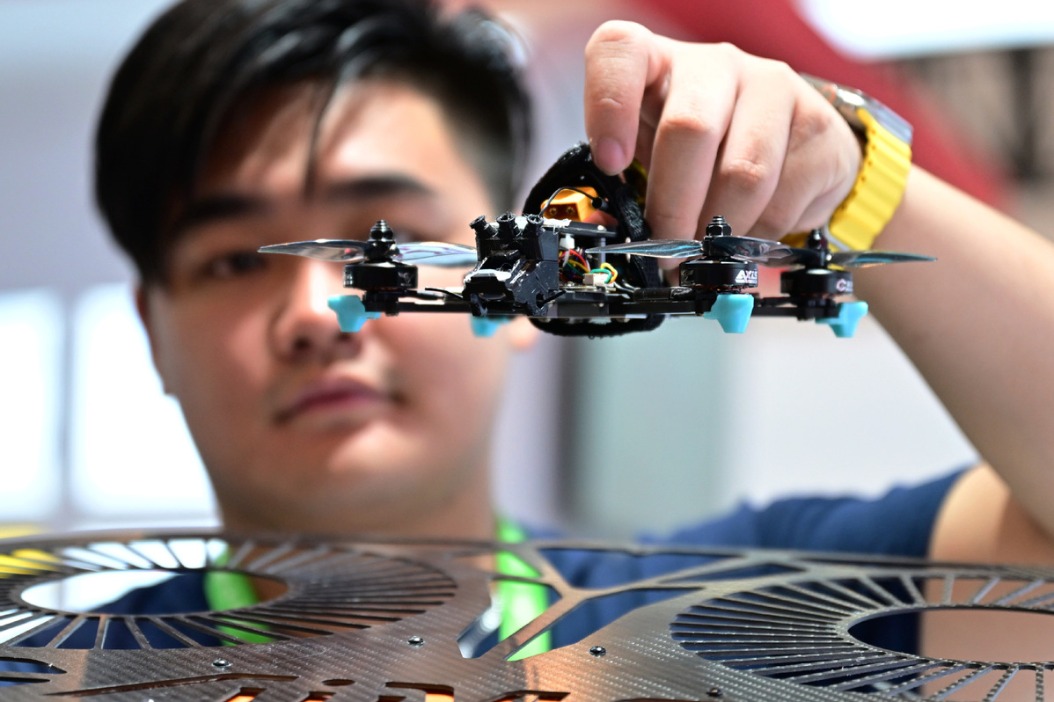

In the first half of 2018, a raft of policies and measures were introduced to promote listing by companies from new economy sectors and support development in high-tech areas, including the internet, artificial intelligence and biopharmaceuticals, the report said.

To accelerate the opening-up of the capital market, the introduction of Chinese Depositary Receipts and the Shanghai-London Stock Connect are important measures at the core of the reforms undertaken by China's financial industry to become more international in the second half of 2018.