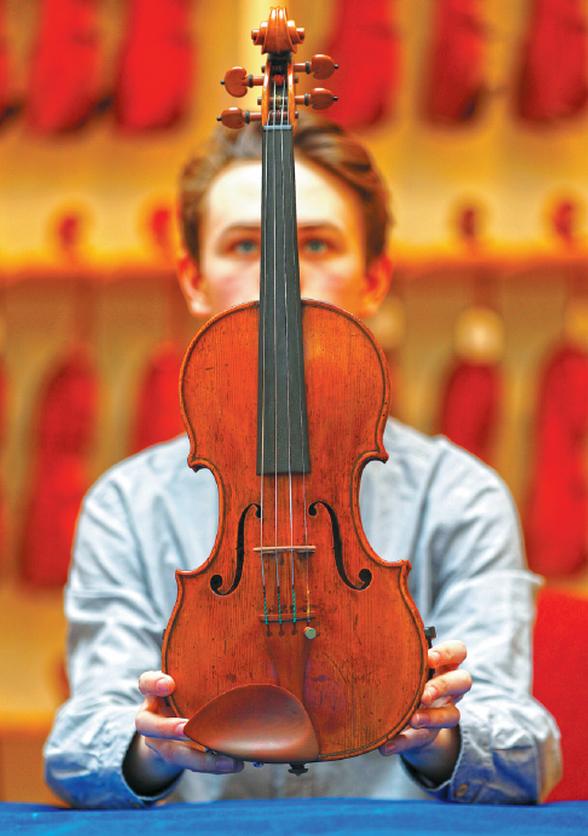

Lovely music, lucrative investment

Exquisite, expensive violins increasingly popular among China's musicians, collectors

The value of "Strad" violins has never gone down.

So says Colin Maki, an American violin dealer who visited China last summer to meet a potential client in Shenzhen, Guangdong province, and spoke to an audience at Yale Beijing Center about how to appreciate the classical instruments not only as works of art, but as reliable financial investments.

The annual investment return of violins by the Italian Stradivari family is about 14 percent, according to data from Rare Violins of New York.

Most people might have only heard of the Stradivari violins by name or their exquisite sound during concerts held at first-tier cities, but never seen them with their own eyes.

That is because only a limited number of such high-end violins are well preserved. They have been owned and traded for years among a small number of investors around the globe, as exorbitant prices have pushed most people out of the market.

The violins made by the best violin makers in history - Stradivari, Guarneri del Gesu and Giovani Battista Guadagnini, cost as much as a fine Manhattan apartment.

Prices have surged as there is only a finite supply and limited access to these rare items of the violin family, with approximately 600 Stradivari instruments and 140 Guarneri del Gesu violins known to have survived today.

One of the most expensive recorded sales in recent years was a 273-year-old violin by Guarneri del Gesu, which was sold for more than $16 million.

Alongside the preservation of an art form that has been cherished throughout several centuries, wealthy investors have reaped significant high returns that have proven more stable than US bond yields.

"You can just hold the violin for years and see its price soar," Maki said.

Prior to operating an independent consultancy based in New York City, he served as sales manager for the firm of Carl Becker and Son in Chicago and as senior specialist for Tarisio Auctions.

Maki spent most of his time traveling to different parts of the world, meeting clients and presenting them fine, valuable instruments. It usually takes several months to close a deal.

Most of his clients are from Europe and the United States - the latter of which is the most mature market; according to Maki, the country has all kinds of services for clients including advisors, instrument authentication, grading and restoring. Such services can rarely be found in China.

Still, though few people among the audience at the Beijing public event were able to afford such fine violins, Maki feels the market here has great potential, and is worth cultivating. Maki's visit to China last summer was, in part, to bring four violins made during the 17th to 18th centuries by the best Italian violin makers to a potential client in Shenzhen.

"We found a flow (of trade) happened in recent years - more fine instruments moved from Europe to Asian countries, such as Japan, China and (South) Korea," he said, adding that the increasing demand from Asian markets has played a role in driving up prices for the instruments.

In 2014, a "General Dupont Grumiaux" Stradivarius violin made in 1727 was sold to an anonymous collector in China, becoming the first Stradivarius to be owned by a private individual in the country.

Tim Ingles, director of Ingles & Hayday, a specialist fine and rare musical instrument auction house and dealership, also feels optimistic about the growth potential of the Chinese musical instrument market.

"Interest in Western classical music and Western art is a relatively recent phenomenon in China, but it is now spreading fast, with new concert halls being built in many major cities and leading US and European orchestras visiting for concerts. This will inevitably create a general interest in classical music and in fine musical instruments," Ingles said.

In the meantime, a rising number of soloists in China, who need great instruments, are driving up the demand, he said.

There are already some wealthy collectors who are buying violins by Stradivari and Guarneri and loaning them to soloists.

Apart from professional dealers who have years of experiences, some domestic amateurs are trying to bring rare investment collections to common music lovers in China.

Two Beijing-based musicians, for instance, are about to finish a one-year violin crowdfunding program in March, the first of its kind in the country.

Zhang Maolun, a Beijing-based legal consultant and an amateur violinist, has long considered the idea of bringing rare instrument collections to more people and getting them together to learn more about the collections.

He discussed the idea with his friend - and eventual partner - Song Liqiang, a cellist who owned an instrument store near the Central Conservatory of Music in Beijing.

A total of 500,000 yuan ($79,750) will be raised through the crowdfunding program, and all investors are assured of repayment in cash plus interest after one year.

The idea was that investors would lend them the money to lease a violin for one year, during which time the two dealers will find the next buyer with a higher price so that investors are able to receive returns as pledged after the deal is closed.

During the period, the investors are able to play the violin and participate in lecture events held by musicians.

The idea remained vague until Liu Xiao, a renowned Chinese violinist and a professor with the Central Conservatory of Music, commissioned Song to sell his violin in his instrument store.

The violin was made during their golden period by famous Italian violin makers Lorenzo and Tomaso Carcassi, brothers who are believed to have been pupils of the well-known master Giovanni Battista Gabrielli.

"The violin fits all the requirements for the crowdfunding program," said Song, who often travels around the globe to collect instruments. "It's well-preserved and has a proper value that can be afforded by a small number of people."

Zhang and Song contacted Florian Leonhard, one of the world's finest living violin makers and authenticators, to get a certification for the violin's condition and quality, which added value to the instrument.

They decided to raise a total of 500,000 yuan split into 50 shares, each of which is guaranteed to receive a fixed return in one year, according to the contract.

"We set the return at a pretty high level because we feel the violin can be sold at a higher price than the capital we raised plus pledged returns," Song said. "We want to attract more people to participate in the first project of this kind."

The crowdfunding program attracted investors from Beijing, Guangdong and New York soon after information about it was posted on WeChat.

"I did not think too much about risks. I talked to other participants before joining in, and we all agreed that it is a valuable project," said Li Wozhou, a violin amateur based in Guangdong, who found the information online and later decided to invest.

"Having the chance to play one of the finest violins is rare," said Li, adding that it is the additional benefits - sharing information and learning more knowledge - that really attracted him to make the investment.

After selling the violin, Zhang and Song plan to launch the next program on a crowdfunding platform run by some e-commerce companies.

"I think in the near future, wealthy collectors in China might still prefer to collect porcelains and paintings than rare musical instruments. We hope to keep our channel open to a group of people who have interests in instrument collections," Zhang said.

Related story: Chinese art market expected to recover, China Daily

The once-hot art market is expected to recover in China, according to recent market research.

In the next three years, wealthy Chinese individuals will have a stronger appetite to invest in art and antiques and less willingness to invest in monetary assets, according to the annual Hurun Chinese luxury consumer survey released in January.

Calligraphy and paintings continue to take the lead this year as wealthy people's "favorite collectibles", followed by jewelry, watches and contemporary art, the report said.

The report was based on a survey of 463 millionaires with a personal wealth of at least 10 million yuan ($1.58 million).

A likely rebound of sales goes hand in hand with overall economic recovery in China and in other countries.

The global art market slid 11 percent year-on-year in 2016, driven down by weak global economic growth, uncertainties over Brexit and remaining problems associated with the post-2008 financial crisis, according to Huang Jun, an economics professor with Renmin University of China.

The presence of more and more millionaires in China, where younger collectors have significantly increased in recent years, is expected to drive a rebound of the art market, Huang said.

More types of art investment vehicles and the application of securitization techniques are expected to help revive the art market, she said.

The sales volume of fine arts alone at public auctions in China rocketed in barely 10 years to reach 41 percent of the global market in 2011, the biggest share in the world, according to data from Artprice, a specialist in art market information.

The sales of artworks peaked in the country in 2011 and began to decline in recent years.

Government efforts to curb luxury spending and the anti-corruption campaign have played a role in cooling down the Chinese buying frenzy, according to a study of the Chinese art market by artnet, an art market website.