Trade war fears savage stocks

Analysts: A-share market will pick up in the long term despite recent pressure

The stock market plunged on Friday in line with a global pattern, on fears of a trade war between China and the United States, the world's two largest economies.

The benchmark Shanghai Composite Index dropped 3.39 percent to close at 3,152.76, while the Shenzhen Component Index closed at 10,439.99, down 4.02 percent.

Listed companies with the majority of their revenue made up by exports to the US saw their prices slump. Hangzhou-based smart medical services provider Ewell Technology and Foshan-based Guangdong Dongfang Precision Science& Technology saw their prices down by more than 9 percent.

A memo signed by US President Donald Trump this week is a result of a Section 301 investigation under the US Trade Act of 1974 into China's laws, policies, practices or actions related to technology transfer, intellectual property and innovation. Industry insiders said tariffs are most likely to be imposed on the information technology sector.

As a result, A-share listed companies specializing in technology, electronics, telecommunications and industrial internet saw the most significant price slumps on Friday, according to information provider Wind.

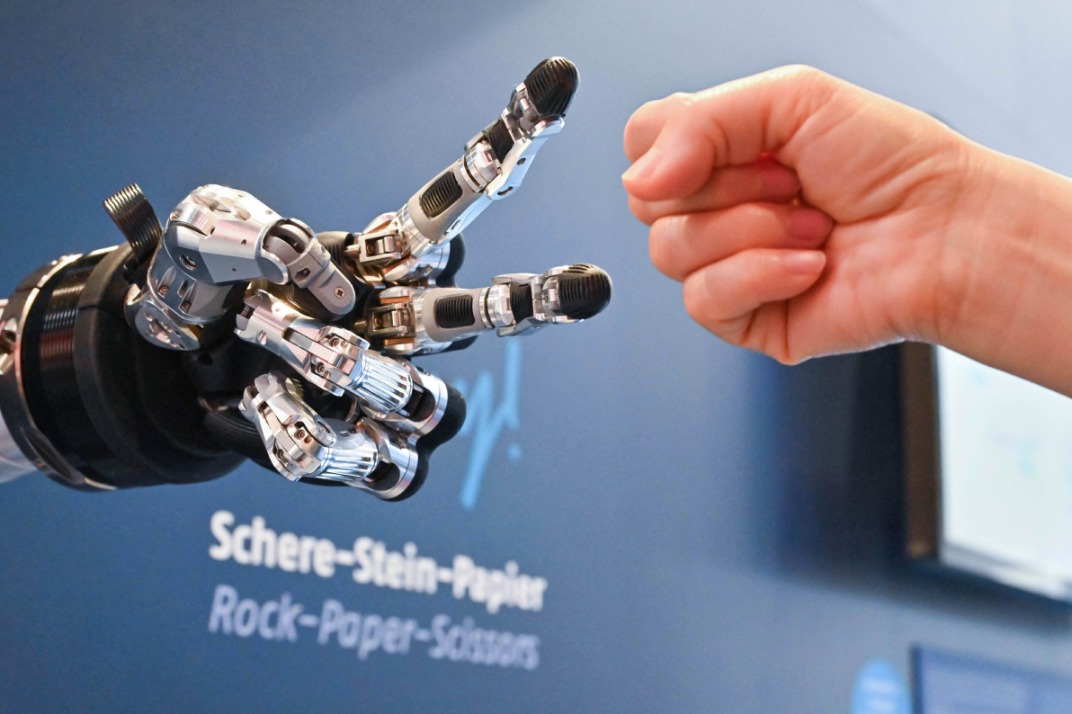

Simon Baptist, managing director at The Economist Intelligence Unit Asia, wrote in a note that China is going to be a giant in the technologies of the fourth industrial revolution such as artificial intelligence, robotics and automation.

"The US moves could slow that, but they won't stop it," Baptist wrote.

"China is so integral to global supply chains for many products that a good portion - but not all - of the tariff impact will be passed onto US consumers. US firms will be the bigger losers," he added.

The commodity market didn't report any good news either on Friday. Chinese steel futures shed more than 6 percent to their lowest levels in more than eight months, while iron ore dropped to levels unseen in nearly nine months.

Markets in other parts of the Asia-Pacific region were also hit by the latest US move. Japan's Nikkei 225 Stock Average dropped 4.66 percent to close at 20,586.5 on Friday. Hong Kong Hang Seng Index closed at 30,309.29, down 2.45 percent.

But analysts from Shanghai-based Guotai Asset Management said that the US moves will not impair the attractiveness of the A-shares market in the long run. The market confidence might be affected in the short term, but it is mainly driven by domestic economic performance.

"China's economy took off quite well in the beginning months of this year. As more social capital will be reallocated, the A-shares market is still lucrative," according to Guotai's note.

Experts from Shanghai Sinolink Securities also agreed that the A-share market will pick up in the long term despite the recent pressure.

shijing@chinadaily.com.cn

- US tariff measures detrimental to global industrial chains: Experts

- US tariffs on Chinese imports risk disrupting US, global trade, say economists

- CEOs, experts weigh in on trade war at China forum

- China prepared to fight back on US trade actions, says expert

- BlackRock CEO: Trade war won’t solve problems