US triggering a trade war it can't win

Protectionist from the start, US President Donald Trump's administration has now moved from rhetoric to action in its avowed campaign to defend US workers from what Trump calls the "carnage" of "terrible trade deals". This approach is backward-looking at best. At worst, it could very well spark retaliatory measures that will only exacerbate the plight of beleaguered middle-class American consumers. This is exactly how trade wars begin.

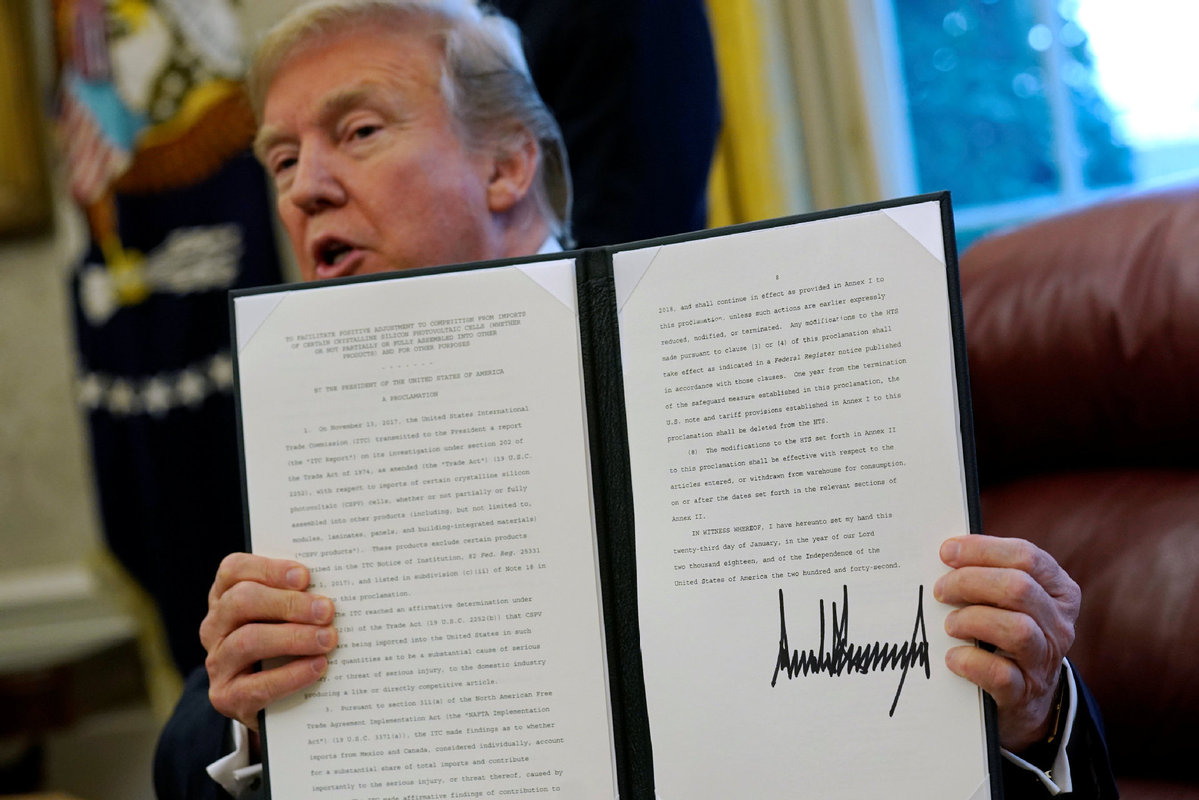

China is clearly the target. The Jan 23 imposition of so-called safeguard tariffs on imports of solar panels and washing machines under Section 201 of the US Trade Act of 1974 is directed mainly at China and the Republic of Korea. Significantly, the move could be the opening salvo in a series of measures.

Last August, the US Trade Representative launched Section 301 investigations against China in three broad areas: intellectual property rights, innovation, and technology development. This is likely to lead to follow-up sanctions. Moreover, a so-called Section 232 investigation into the national security threat posed by unfair steel imports also takes dead aim at China as the world's largest steel producer.

The problem is Trump's 'America First' policy

These actions hardly come as a surprise for a president who promised in his inaugural address a year ago to"… protect (America's) borders from the ravages of other countries making our products, stealing our companies, and destroying our jobs". But that's precisely the problem. Notwithstanding the Trump administration's cri de coeur of "America First", the United States could well find itself on the losing side of a trade war.

For starters, tariffs on solar panels and washing machines are hopelessly out of step with transformative shifts in the global supply chains of both industries. Solar panel production has long been moving from China to countries such as Malaysia, the ROK and Vietnam, which now collectively account for about two-thirds of the US' total solar imports. And Samsung, a leading foreign supplier of washing machines, has recently opened a new appliance factory in the US state of South Carolina.

Moreover, the Trump administration's narrow fixation on an outsized bilateral trade imbalance with China continues to miss the far broader macroeconomic forces that have spawned a US multilateral trade deficit with 101 countries. Lacking in domestic savings and wanting to consume and grow, the US must import surplus savings from abroad and run massive current-account and trade deficits to attract foreign capital.

Consequently, going after China, or any other country, without addressing the root cause of low savings is like squeezing one end of a water balloon: the water simply sloshes to the other end. With US budget deficits likely to widen by at least $1 trillion over the next 10 years, owing to the recent tax cuts, pressures on domestic savings will only intensify. In this context, protectionist policies pose a serious threat to the US' already daunting external funding requirements-putting pressure on US interest rates, the dollar's exchange rate, or both.

In addition, the US' trading partners can be expected to respond in kind, putting export-led US economic growth at serious risk. For example, retaliatory tariffs by China-the third-largest and fastest-growing US export market-could put a real crimp in America's leading exports to the country: soybeans, aircraft, a broad array of machinery, and motor vehicle parts. And, of course, China could always curtail its purchases of US Treasuries, with serious consequences for financial asset prices.

Finally, one must consider the price adjustments that are likely to arise from the inertia of existing trade flows. Competitive pressures from low-cost foreign production have driven down the average cost of solar installation in the US by 70 percent since 2010. The new tariffs will boost the price of foreign-made solar panels-the functional equivalent of a tax hike on energy consumers and a setback for efforts to boost reliance on non-carbon fuels. A similar response can be expected from producers of imported washing machines; LG Electronics, a leading foreign supplier, has just announced a price increase of $50 per unit in response to the imposition of US tariffs. American consumers are already on the losing end in the Trump administration's first skirmishes.