China can help US with infrastructure plan

In the National Security Strategy report released in December, US President Donald Trump announced that the United States will launch a $1 trillion infrastructure building plan in 2018, which, if implemented, will be the largest US infrastructure expansion and upgrading campaign since the 1950s.

Considering China's more than 30 years of infrastructure construction experience and huge capacity and advanced standards, management and innovation technologies, its expanded cooperation with China in this area will serve both countries' common interests. Successful Sino-US infrastructure construction cooperation will set an exemplary model for China's cooperation with other countries; it will also produce spillover effects and consequently boost global interconnectivity.

Trump's domestic economic policy focuses on infrastructure, tax cuts, shrinking balance sheets and withdrawing the US from international agreements and organizations. However, such a policy combination faces some intrinsic contradictions and conflicts, given that expanded infrastructure construction and tax cuts are constrained by the upper debt ceiling while tax hikes increase the financing costs for fiscal expansion.

China's rich experience in infrastructure construction can be shared by the US. The priority accorded to infrastructure construction by Trump will motivate more Chinese enterprises that have high standards and technological advantages to explore the US market for commercial opportunities.

New opportunity could boost global growth

Sino-US infrastructure construction cooperation will also bolster global economic growth. The world's two largest economies account for about 40 percent of global gross domestic product and their exports 32.8 percent of global exports. Closer cooperation in infrastructure will bring the two economies closer and deepen bilateral political mutual trust and people-to-people exchanges, thus stabilizing the global economy and promoting all-round prosperity.

Chinese enterprises' increasing involvement in the US' infrastructure construction will make them more acquainted with international rules, and create opportunities for them to learn advanced technologies and seek inspiration from global experiences, which in turn will help them to adapt to the strict business environment in Western countries and comprehensively raise their international competitiveness.

More important, increasing China-US infrastructure construction cooperation will ease bilateral trade tensions. After more than three decades of fast development--China has accumulated the highest foreign reserves of $3.14 trillion by the end of 2017--$1.19 trillion, or 38 percent, of which has been invested in US national debts. As China is the largest creditor of the US, pragmatic infrastructure construction cooperation with China will ease the insufficient funding pressure on the US, help boost its economic growth and employment and mitigate its trade deficit with China.

As two influential global powers, China and the US are indispensable pillars of the world order, and how they deal with each other will have a great bearing on the global configurations. Bilateral frictions in trade and investment, especially the deteriorating security environment in the Asia-Pacific region, have to some extent obstructed the smooth development of Sino-US relations. Beijing and Washington should understand that bilateral disputes on trade deficit, making of global trade rules and intellectual property rights protection are unavoidable in an era of "competitive cooperation".

What they should do is to seek consensuses on the basis of mutual understanding, and build an open, transparent, and efficient economic system. They should also realize that the proper settlement of economic disputes is of particular importance to avoiding political conflicts.

Both sides should make pragmatic efforts

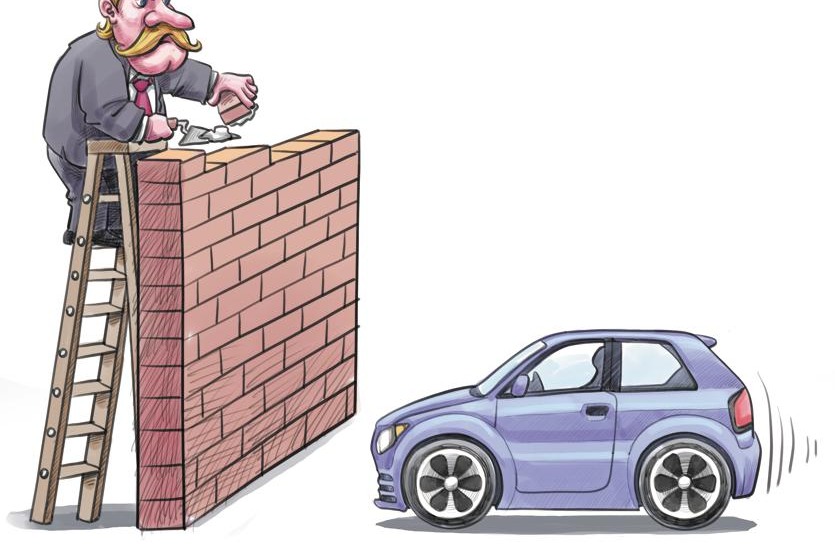

\The US should consider practical measures to reduce the uncertainties resulting from its tightened scrutiny of Chinese investment, and gradually open wider its infrastructure, technology and energy markets to Chinese investors to strengthen Sino-US cooperation.

The $253.5 billion deals struck by the US with China during Trump's visit to China show the real potential of bilateral cooperation, and both sides should grasp any opportunities for win-win cooperation, such as in the field of infrastructure construction.

The US needs $8 trillion for infrastructure expansion and upgrading in the next 20 years, which offers enormous opportunities for global investors, including Chinese enterprises and individuals. Expanded Beijing-Washington infrastructure cooperation will advance broader and deeper bilateral economic cooperation and increase the chances of the two sides signing a "Bilateral Investment Treaty". To facilitate the process, China and the US should include infrastructure construction cooperation into bilateral economic and trade cooperation planning. In particular, China should more actively hold pragmatic negotiations with the US, as well as strengthen policy coordination in the field of infrastructure construction.

Also, China and the US should promote public diplomacy to strengthen mutual trust and reduce conflicts, which will help develop a new type of major-country strategic partnership with the US. In such a way, a more favorable public opinion foundation for a better image of China will emerge.

The two sides should also strengthen inter-governmental consultation and coordination and consider the inclusion of bilateral infrastructure cooperation in their established dialogue mechanisms to guide and push for implementation of such cooperation projects. For example, under Sino-US Strategic and Economic Dialogue and other dialogue mechanisms, China should negotiate with the US to convince the latter to pragmatically scrutinize Chinese acquisition deals, open its market and relax restrictions on high-tech exports to China. On the other hand, China should form a research team to determine the possibilities and magnitude of Chinese enterprises' participation in US infrastructure construction projects.

China has the largest foreign reserves in the world. But given the loose monetary environment of the times, it also faces the dilemma of how to turn its huge soft-dollar assets, such as US government bonds, into hard-dollar assets to fend off inflation in the future. One of the feasible options is to transform some of these assets into US infrastructure equities, because they are better protected.

China should also work to promote the integration of its project technologies, standards and norms to those in the US, in order to ward off future risks. Chinese investors also face the risks of political and labor disputes, environmental protection and exchange rate when it comes to their involvement in infrastructure construction projects in the US, which highlight the need for them to take better precaution against such risks to protect their interests by using financial and economic tools and other methods.

Considering Trump's repeated stance that the US' infrastructure construction will use homemade products and his promise to create 25 million jobs at home, Chinese companies involved in US' infrastructure construction projects should adapt themselves to the local market, laws and government requirements, and help create more local employment and increase procurements, so as to lower man-made barriers to their access to the US market.

The author is chief economist of China Development Bank.