Investors cheer tango of old, new economies

BEIJING-In China, old economy and new economy are joining hands, bringing more long-term investment options to the capital market, analysts said.

Old economy refers to traditional sectors and manufacturing, while new economy refers to innovation, internet-based businesses, the digital world, high-tech enterprises, so on.

Insurance may lack the glamor and cachet of tech companies, yet shares of one insurer, which reinvented itself for the 21st century, kept pace with some of the digital darlings last year, suggesting old economy is not redundant.

"The world has moved too much to 'new' and 'old' categorizations," said Joshua Crabb, head of Asian equities at Old Mutual Global Investors in Hong Kong.

Ping An Insurance (Group) Co's "phenomenal performance" on the stock market reflects its emergence as a combination of a "boring old" life insurer and a "leading internet company," he said.

Another star that has transcended the "boring" classification is China Molybdenum Co, which at one point focused on a metal used to toughen steel, but now enjoys a new-economy style valuation, thanks to its holdings of cobalt, which is essential for electric vehicles.

Midea Group Co, a household appliance maker, has seen its stock soar after it developed smart home technology and became a leader in manufacturing automation products.

Ping An Insurance's stock-market capitalization increased by $101 billion last year, a gain that Crabb attributes to its investments in online services and bets on rising demand for insurance as China's middle class expands.

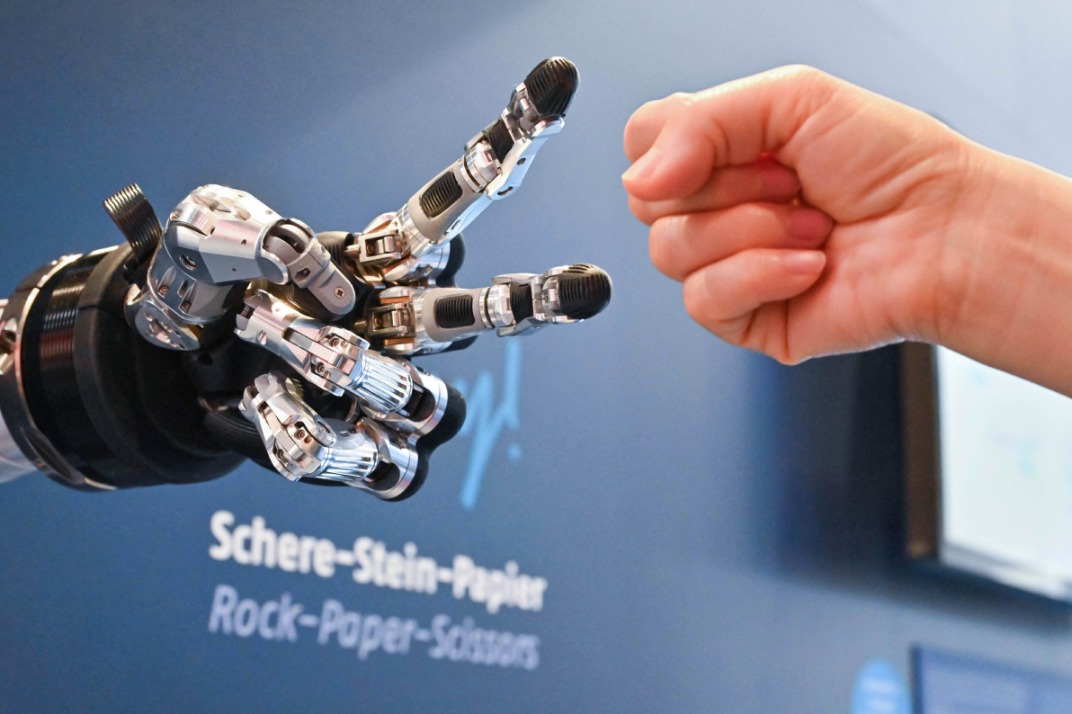

Similar dynamics are driving change in a host of industries, from auto manufacturing to property development, with the application of digital technology such as the internet of things or IoT revamping the landscape.

"In China, we have found a lot of cases where the old or traditional economy starts to adopt new technology to redefine itself," said Xia Le, an economist at Banco Bilbao Vizcaya Argentaria SA in Hong Kong. "The nature of recent technological advances is that they didn't lead to the rise of new industries, but rather they were applied to traditional industries."

A research note by UBS Securities said, "China has so many excellent enterprises. As the market has been strengthening its risk management capacities, more new-economy companies will seek financing in the market, which offers choices to investors."

Investors could miss out if they only consider front-line technology companies and overlook how old-economy businesses are evolving, said David Gaud, Asia chief investment officer at Pictet Wealth Management in Singapore.

In the auto space, some carmakers are embracing new-energy vehicles along with deploying robots. In property, developers have the potential to incorporate technology and use big data to shift into providing services for tenants, Gaud said.

"What is considered as old economy and uninteresting may turn into sectors that are more in line with the current economy-and they are cheap," he said, without mentioning specific stocks or sectors that he regards as offering attractive valuations.

Technically, new technologies will boost performance and efficiency of traditional technologies, such as in textiles.

A research note from Fortune Securities said, "Just think about fabric development and how it is helped by big data analysis to cater to consumer preference, and how new materials will enable new possibilities."

As for Ping An Insurance, its valuation at 17 times reported earnings is still a third that of technology shares on the MSCI China Index, according data compiled by Bloomberg.

Midea, the appliance maker that bought German robot champion Kuka AG last year and is promoting so-called smart home devices, has seen its stock soar 95 percent the past year, putting its valuation at 22 times reported earnings.

China Molybdenum, whose cobalt goes into rechargeable batteries used in electric vehicles, is up 174 percent over that time in Hong Kong, with a price-to-earnings ratio of 37.

This confluence of the rapid emergence of a China propelled by value added and the penetration of technology into all aspects of daily life will reshape the global economy, said Tan Teng Boo, a fund manager at Malaysia's Capital Dynamics Sdn Bhd.

"Ten, 20 years from now, you would say 'I can't see the difference between the old and the new anymore'," Tan said.

China Daily - Bloomberg